Objectives of the service

The users of BirdsEyeView’s RAPTOR™ technology consist of underwriter’s that insure large special events globally.

Currently, underwriters struggle to accurately model the likelihood of a Natural Catastrophe (“NatCat”) / extreme weather event hitting an insured location. Adverse weather and natural disasters account for nearly 80% insurance premium calculation and therefore accurate analytics and modelling is critical when the insurer is pricing the insurance policy. In addition to this, underwriters find that it is neither time nor cost-efficient to underwrite smaller insurance policies manually.

BirdsEyeView’s RAPTOR™ technology both:

-

automates the underwriting process, enabling brokers to submit, quote, and bind special event insurance products online. The underwriting as automated using the RAPTOR™’s algorithms; and

-

provides underwriters with the weather analytics needed to correctly price the event insurance.

Both these capabilities reduce the cost of underwriting via automation and increase underwriting performance and profitability through effective pricing and risk management.

The project, working with the participant insurer ‘Arch,’ looks to assess RAPTOR™’s ability to entirely automate the underwriting process for event premiums <£25,000 whilst providing reliable NatCat and extreme weather modelling.

Users and their needs

RAPTOR™’s customers consist of insurance companies writing Special Event (“Contingency”) insurance. Arch Insurance, a large writer of Contingency are the users involved in the activity. They will be using RAPTOR™ for global event insurance risks.

Arch need RAPTOR™ to address the following pain points:

-

For every €1 of insurance premium that a business or customer pays to an Arch, €40p evaporates as a frictional cost of delivering the insurance (McKinsey). Increased automation using algorithmic underwriting software should minimise human involvement and reduce this frictional cost.

-

80% of the insurance premium is based upon the probability of a NatCat / extreme weather event leading to cancellation. They do not currently have access to these probabilistic climate figures globally.

The demonstration project looks to address the following challenges:

-

Assess RAPTOR™’s ability to run large probabilistic models on historical climate data to calculate the likelihood of a NatCat/extreme weather event globally. This must be delivered on an online tool that is both easy to use and retrieves results <10 seconds.

-

Test RAPTOR™’s ability to automate a traditionally manual underwriting process. Broker involvement will be required to assess the RAPTOR™’s ability to automate this process

Service/ system concept

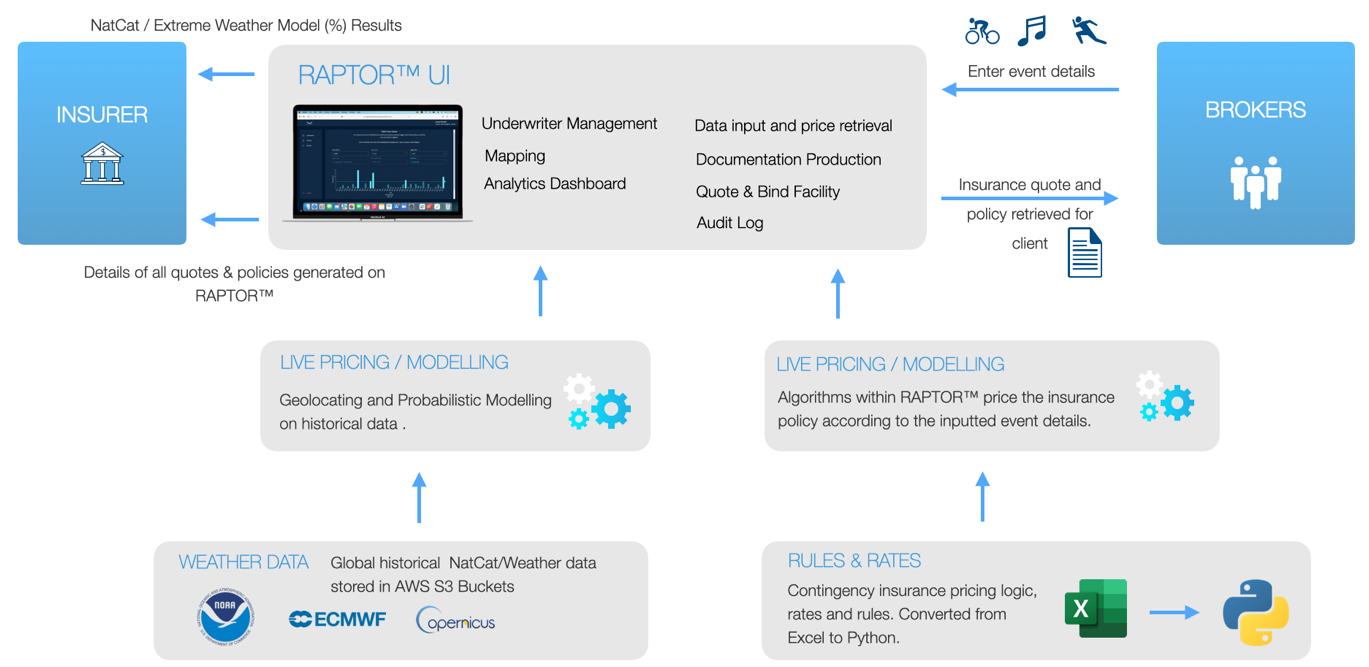

RAPTOR™ is an online tool, accessed via web browser, that will deliver two core capabilities to the User (Arch).

-

Automated Underwriting: Brokers normally present details of the event to Arch’s underwriting team following which, they price the policy on an Excel spreadsheet before manually creating policy wordings and issuing documentation back to the broker. This entire process is automated in RAPTOR™. Arch will be able to login to RAPTOR™ and view all policies and quotes that have been created by the brokers, handling any ‘referrals’ generated that do not fit their underwriting appetite.

-

NatCat/Weather Modelling: For larger events, the underwriters will be able to login to RAPTOR™ > enter the event location > select weather perils of interest > select event dates > select threshold (i.e. mm) > click ‘run.’ RAPTOR™ will run large probabilistic models on historical data and provide the underwriter with a probability (%) figure. This probability (%) is then used to price the insurance premium.

Space Added Value

Space Assets Used:

BEV uses a combination of global historical NatCat/Weather datasets to provide the user with occurrence probability figures for an extreme event occurring. This probability figure (%) is then used to price the event insurance premium.

ECMWF ERA-5 reanalysis data, retrieved from the Copernicus Hub, is the core dataset utilised.

This reanalysis dataset contains a plethora of weather and climate variables derived from a 70+ radar, satellite, and in-situ/ground stations.

BirdsEyeView then runs large probabilistic models over this global historic data to provide occurrence probability (%) figures for extreme / ‘tail risk’ events.

Value over competitor products:

By using ERA-5 climate data from the Copernicus Hub, BirdsEyeView can provide the underwriter with a globally homogenous, consistent, and high-resolution dataset. The net result of this, combined with RAPTOR™’s modelling, is that the underwriter can retrieve am extreme weather occurrence probability figure, based upon the inputted parameters, for any location around the world.

A competitor, one previously used by the user, used only ground-station weather data. Ground station data presents the following issues: 1) There are commonly gaps of over 50km between ground stations presenting issues in data availability and resolution 2) The quality of data retrieved from these ground-stations varies from one country to another. This creates inconsistencies in the results provided.

Current Status

nsurance brokers are transacting insurance premiums through the system with a total of 292 individual brokers signed up to use the system across 104 different organisations.

The total Gross Written Premium (£) bound on RAPTOR is confidential.

A total of 4,947 different event locations have been modelled for their exposure to natural catastrophe’s.