Objectives of the service

Droughts and wildfires are increasing in frequency, intensity, and unpredictability, which is challenging traditional insurance models and exposing clients to greater losses. Delayed claims, ambiguous coverage, and operational disruptions are no longer acceptable.

Our Solution: Parametric Insurance That Works

Our parametric insurance solutions offer pre-defined triggers and automated payouts—delivering speed, clarity, and confidence when it matters most.

-

Pre-agreed triggers based on trusted climate and satellite data

-

Rapid payouts, within days

-

No adjusters. No delays. Just clean execution

-

Customisable to your clients’ unique exposure

Insurers and Brokers Partner with Skyline

✅ Unlock new revenue streams with innovative risk products

✅ Complement traditional indemnity offerings

✅ Reduce basis risk through layered triggers

✅ Trusted by underwriters, backed by science

Describe in less than 200 words the objectives of the service, i.e. what are the key problems of the users, what is the solution you intend to provide and how will you provide it. Please describe also the objectives of the activity (Study or Project). Avoid the use of phrases like “The objective is to investigate the technical feasibility and economic viability...”. Restrict the use of acronyms and make sure there are spelled out at first occurrence.

Users and their needs

The following customers / users will use Skyline’s technology platform for pricing, quoting, and administering parametric insurance products covering drought and wildfire risks with different motivations:

Reinsurers

-

Efficient response enabled by pre-underwritten risk models and technical pricing.

-

A “filter” already undertaken to ensure interest of the policy holder prior to the risk being presented for binding terms and work being undertaken to prepare a quote

Insurers

-

Reduced costs in underwriting and claims processing, enhancing overall profitability.

-

Elimination of conflicts of interest in claims assessment enhances trust and confidence among stakeholders.

Brokers

-

Rapid response capability (within hours) to client inquiries and needs.

-

Flexibility to offer multiple pricing options based on client preferences and risk structures.

-

Access to pre-structured products from capacity markets with integrated risk analysis and modelling.

-

Expedited claims processing ensures swift payments to clients’ post-event.

-

Independent product structuring reduces errors and legal risks, maximising value for clients.

Managing General Agents

-

Similar benefits as brokers in terms of rapid response, flexible pricing, and efficient claims management.

Corporates and Affinity Partners

-

Scalable execution of parametric insurance offerings across diverse markets.

-

Creation of new revenue streams through integrated insurance solutions.

Describe in <200 words the user communities currently targeted, the users involved in the activity, or people who will be using the service/solution. Avoid extrapolating on “possible future users”. Define their needs and what are the challenges for the project to meet these needs. (Try to summarise the user needs, i.e. using a bullet list.).

Also indicate the country/countries of the targeted users.

Service/ system concept

Custom-Built Drought & Wildfire Coverage backed by our Parametric Technology Platform

Skyline’s scalable parametric technology platform, can be white labelled for our partners to provide:

-

Structuring, pricing, quoting and associated documentation (Quotes & Policy Wording)

-

Index calculations, claims settlement and claims notifications

Parametric Drought Insurance

-

Triggers: Satellite-derived NDVI, soil moisture, rainfall deviation

-

Sectors: Agriculture, forestry, utilities, sovereign risk

-

Benefits: Predictable payout structures, no ground-level loss proof required

-

Data Sources: Copernicus, NASA SMAP, CHIRPS, ECMWF

Parametric Wildfire Insurance

-

Triggers: Active fire detection, Fire Radiative Power, burn area thresholds

-

Sectors: Utilities, real estate, critical infrastructure, governments

-

Benefits: Fast cash injections post-event, no property damage validation required

-

Data Sources: WFIGS, NASA FIRMS, EFFIS, VIIRS

Describe in less than 200 words the capability or information supplied to the user, i.e. type of information that is delivered, specific features or functionalities, the capability the user will have when the service is deployed.

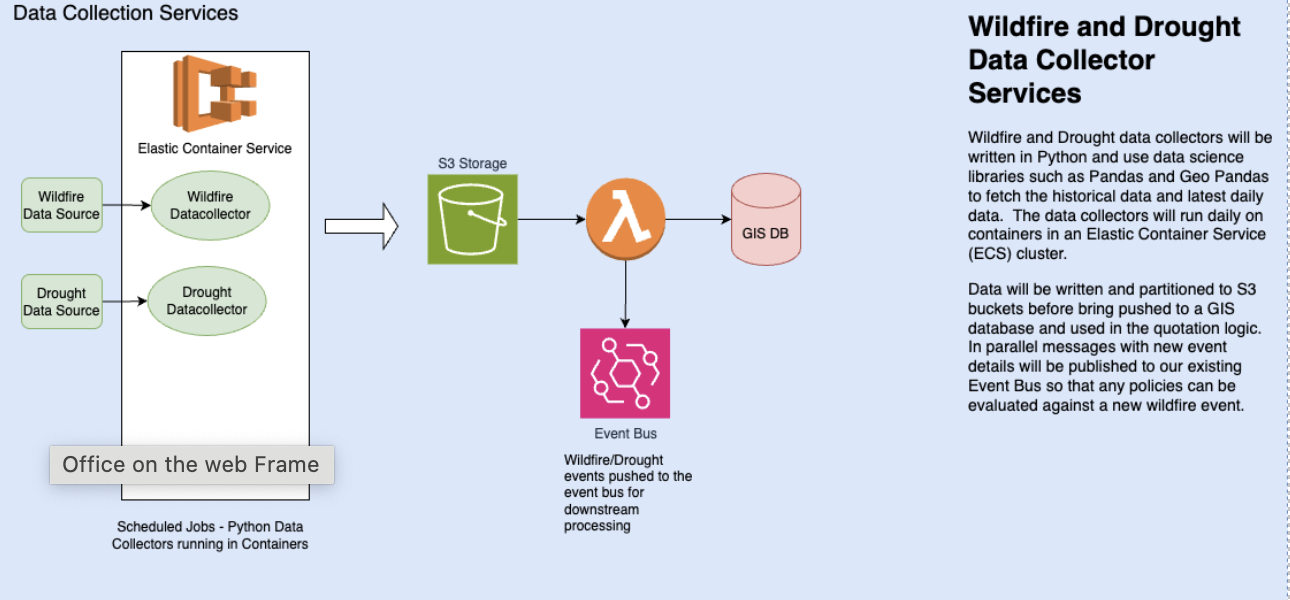

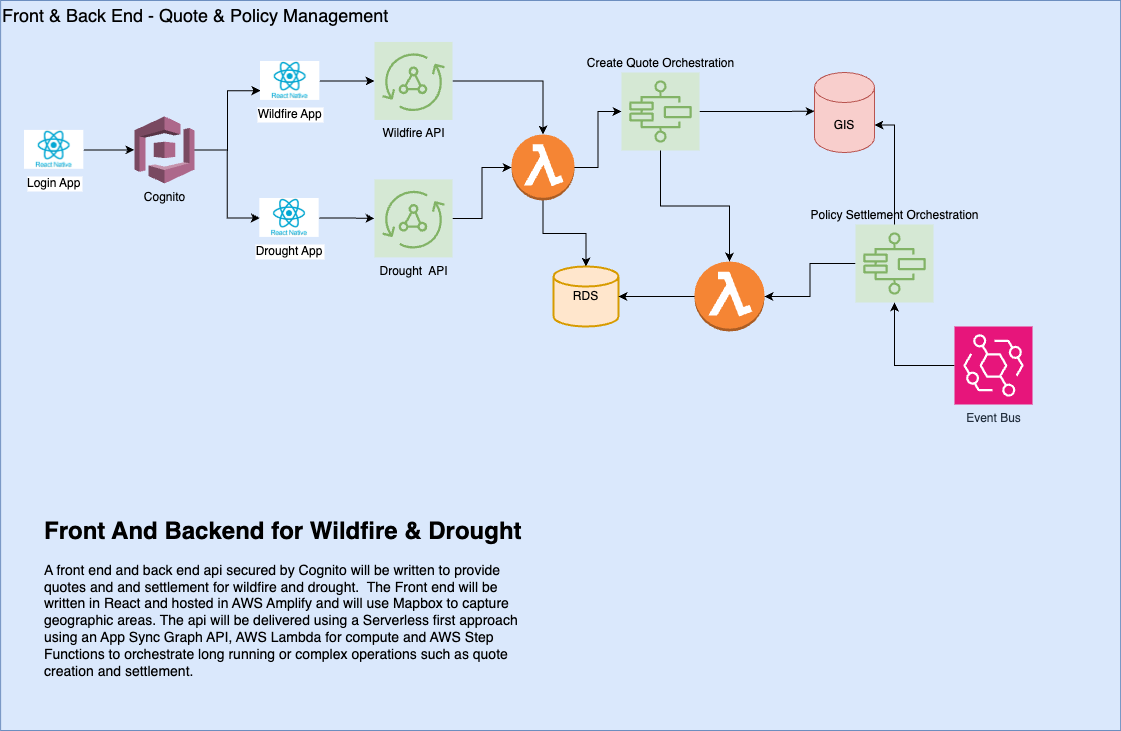

Also explain how the system works in simple terms (no jargon) for a wide audience. Explain the system architecture (on a high level). A simple diagram may be included but make sure it looks good. Don’t use serif fonts or font sizes which are too small to be readable.

Space Added Value

Data is key: For a parametric product to be successfully created and accepted by both the customer and insurer it is necessary to have a source of data for pricing and settlement purposes, well correlated to the financial impacts of the insured. In addition, it needs to be sourced from a trusted provider and be available soon after the event, as the data is used to identify an event and calculate the claim payment. Historical data also need to be available to enable risk modelling and actuarial pricing.

Space technology / space asset(s) intended to be used, and rationale:

Skyline plans to leverage a variety of space-based assets to enhance its parametric insurance solutions.

For Drought the candidate data sources are:

-

ERA5 Land (European Centre for Medium-Range Weather Forecasts):

-

SMOS (Soil Moisture and Ocean Salinity) Microwave Satellite (ESA):

-

Spire’s GNSS-R (European Space Agency Third Party Mission):

For Wildfire the candidate data sources are:

-

MODIS (1km) & VIIRS (375m) active fire & burned area products.

-

Sentinel-2

-

The Wildland Fire Interagency Geospatial Services (WFIGS)

Current Status

Skyline is currently completing the requirements and design phase of the project with significant work undertaken and the data analysis which has informed the product structuring will be implemented in the defined solutions architecture.

Skyline has already engaged with the pilot customers for feedback on the proposed products and with distribution partners already identified for wildfire in California. Some working examples have been provided for the products including example products and payments based on historical events to validate the proposed products and ensure that they will respond as intended.

Wildfire

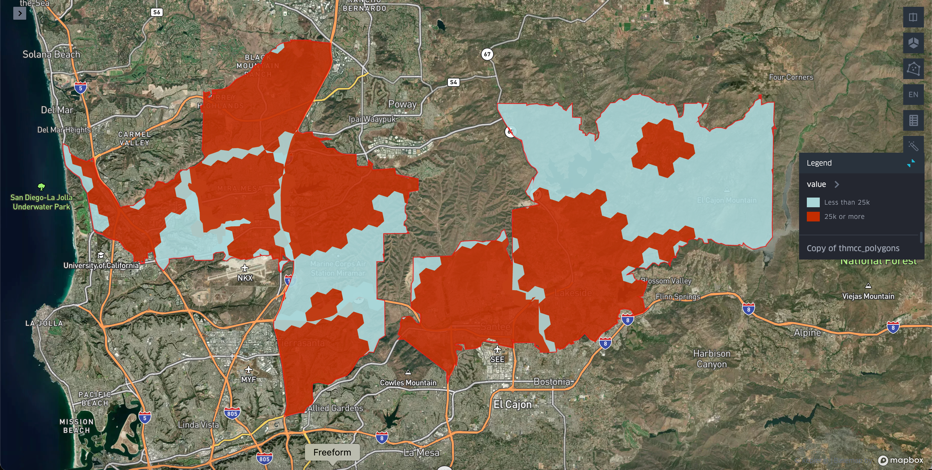

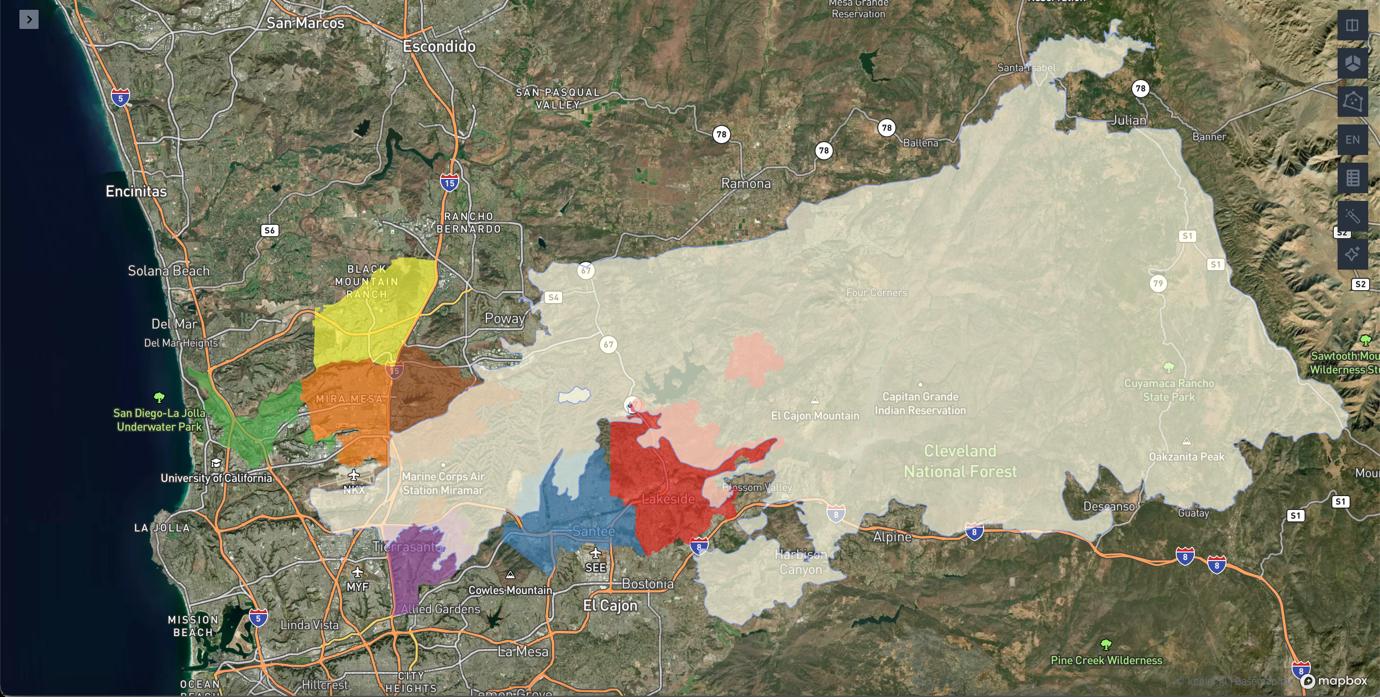

Skyline’s proprietary basis risk reduction algorithm optimizes the selected geometries to truncate zones with no or limited economic value, more likely exposed to wildfire hazard.

- Skyline’s settlement process overlays fire perimeter (using space asset data) with the insured geometries and Tota Insured Values

IIllustration for CEDAR 2003:

Drought

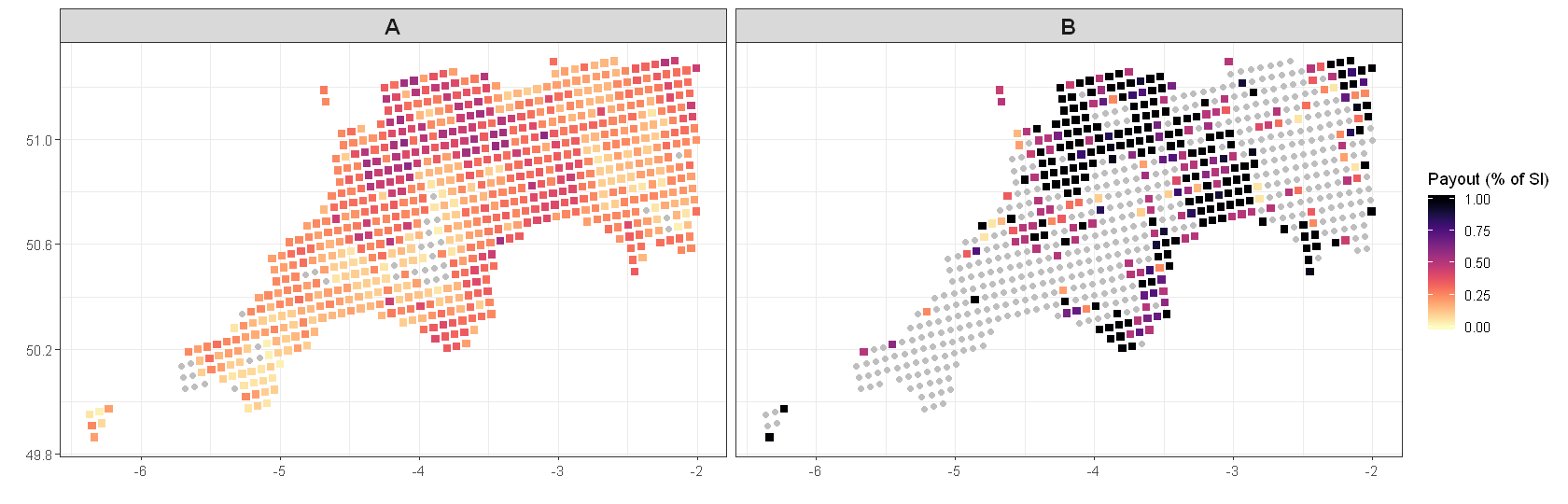

Geographic distribution of the payout due in 2022 as a percentage of the policy Sum Insured for the low deductible & payout rate for 2 options one with highed deductible & payout rate.

Describe in less than 150 words the status of the project. Avoid generic statements like “user requirements gathering” instead say “Held three workshops in different French cities, each one attended by 20 users”. Give a brief summary of achievements, work currently in progress and activities about to start.

The current status section should be updated when major project events are passed e.g. FAT test, SAT test.