Objectives of the service

The objective of the feasibility study “Rheticus® Forest Carbon Offset” is to fulfil the need for a reliability assessment for emissions offsetting investments for companies' sustainability strategies.

Private-market actors (e.g. Oil & Gas and energy companies) need to compensate for CO2 emissions through reliable projects; consultancy companies need reliable information on offsetting investments to design private companies’ sustainability strategies effectively; investment funds need a risk assessment to address investments to well-performing and stable bonds over time.

The need for a reliability indicator of credits from forest conservation projects exploded in January 2023, when The Guardian published the results of an investigation stating that more than 90% of rainforest offset credits from one of the biggest certifiers are likely to be “phantom credits” and do not represent genuine carbon reductions (Greenfield, P. (2023) Revealed: More than 90% of rainforest carbon offsets by biggest certifier are worthless, analysis shows, The Guardian, January 18th, 2023).

The “Rheticus® Forest Carbon Offset” study aims to assess the feasibility of a service providing a synthetic, fully automated rating of offsetting projects through objective geospatial data and methods based on Earth Observation technologies.

Users and their needs

The study “Rheticus® Forest Carbon Offset” addresses several customer segments:

-

private-market users: private companies emitting CO2 that consider Nature-Based projects on Forests as part of their offsetting strategy, must be sure that projects they are investing in will be generating credits and could actively help with compensating such emissions. The service could actively respond to this requirement by measuring the correct forest carbon stocks.

-

consultancy firms: by including environmental risk factors in the forest area analysis, customers can benefit from a considerable reduction of intrinsic uncertainty typical of forestry investments. When customers have to manage more than one Nature-Based project, they should be able to classify projects by the credits generated, so that a project ranking from the lowest risk (highest credits rate) to the highest risk (lowest credits rate) can be the primary outcome.

-

investment funds: thanks to correct and reliable carbon stocks estimations, the derived carbon credits could be safely commercialised along the value chain, so that investment funds/equity could address investments to well-performing and stable bonds over time.

Targeted customers can be based worldwide.

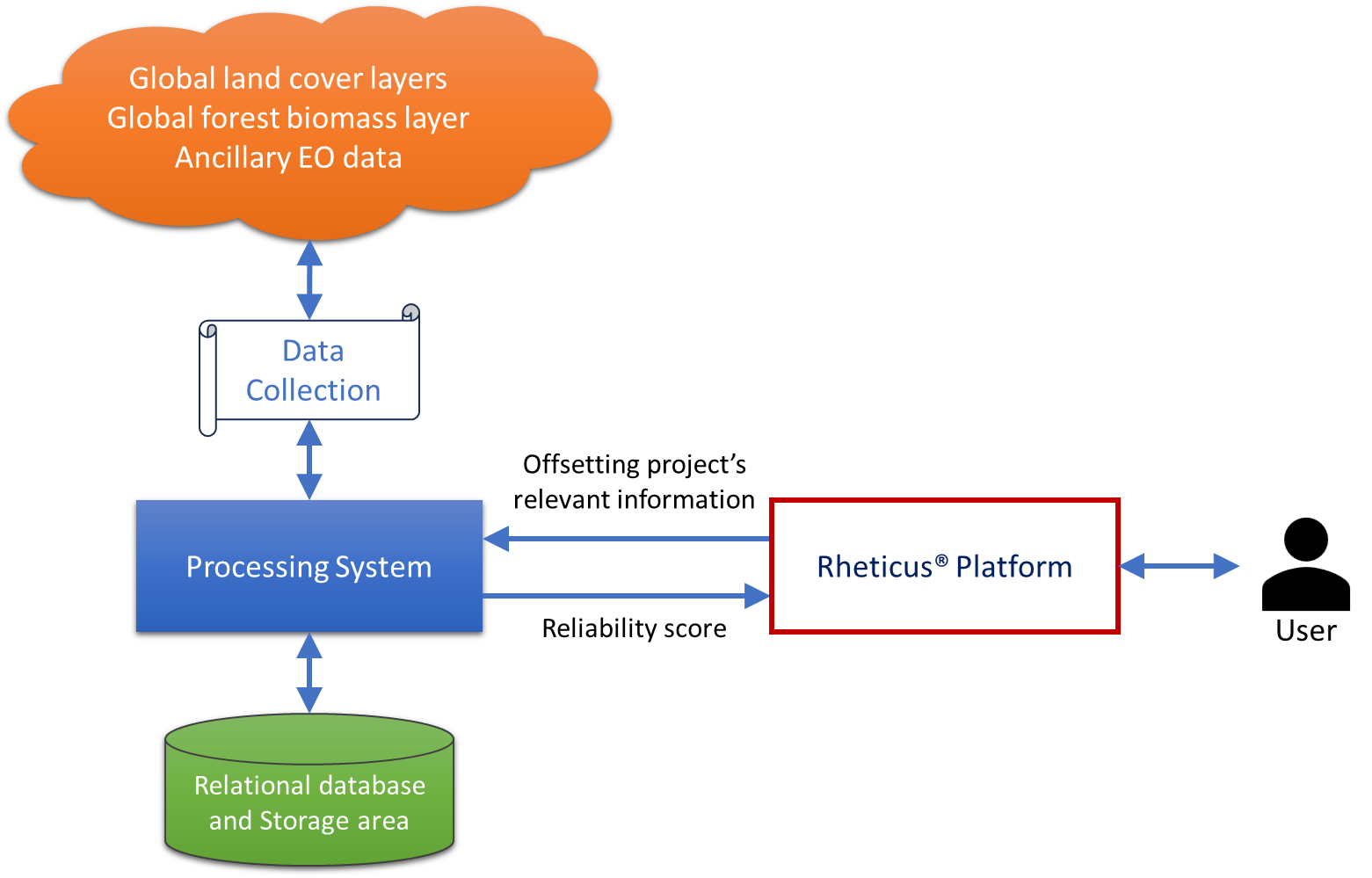

Service/ system concept

The study “Rheticus® Forest Carbon Offset” addresses several customer segments:

private-market users: private companies emitting CO2 that consider Nature-Based projects on Forests as part of their offsetting strategy, must be sure that projects they are investing in will be generating credits and could actively help with compensating such emissions. The service could actively respond to this requirement by measuring the correct forest carbon stocks.

consultancy firms: by including environmental risk factors in the forest area analysis, customers can benefit from a considerable reduction of intrinsic uncertainty typical of forestry investments. When customers have to manage more than one Nature-Based project, they should be able to classify projects by the credits generated, so that a project ranking from the lowest risk (highest credits rate) to the highest risk (lowest credits rate) can be the primary outcome.

investment funds: thanks to correct and reliable carbon stocks estimations, the derived carbon credits could be safely commercialised along the value chain, so that investment funds/equity could address investments to well-performing and stable bonds over time.

Targeted customers can be based worldwide.

Space Added Value

Non-commercial Satellite Earth Observation space assets and derived data are used to provide the service, such as Sentinel-2, Copernicus Global Land Cover, and ESA World Cover. Data from ESA’s BIOMASS are also foreseen.

These space assets can provide significant added value to a service that assesses the reliability of carbon-offsetting investments, for example:

-

accuracy and transparency: Earth observation data and derived maps offer high-resolution and accurate measurements of land cover and forest biomass. In particular, accuracy is crucial for assessing the true carbon sequestration potential of a given area, ensuring that carbon offsetting claims are based on reliable data.

-

consistency and comparability: consistent and comparable assessments across different regions and periods are allowed. Consistency, in particular, is essential for evaluating the long-term effectiveness of carbon offset projects.

-

continuous updates: sometimes information regarding natural and anthropogenic pressures on an area can be outdated, while Earth Observation can provide continuously updated information, which is crucial for assessing how they influenced forest extension or degradation through time.

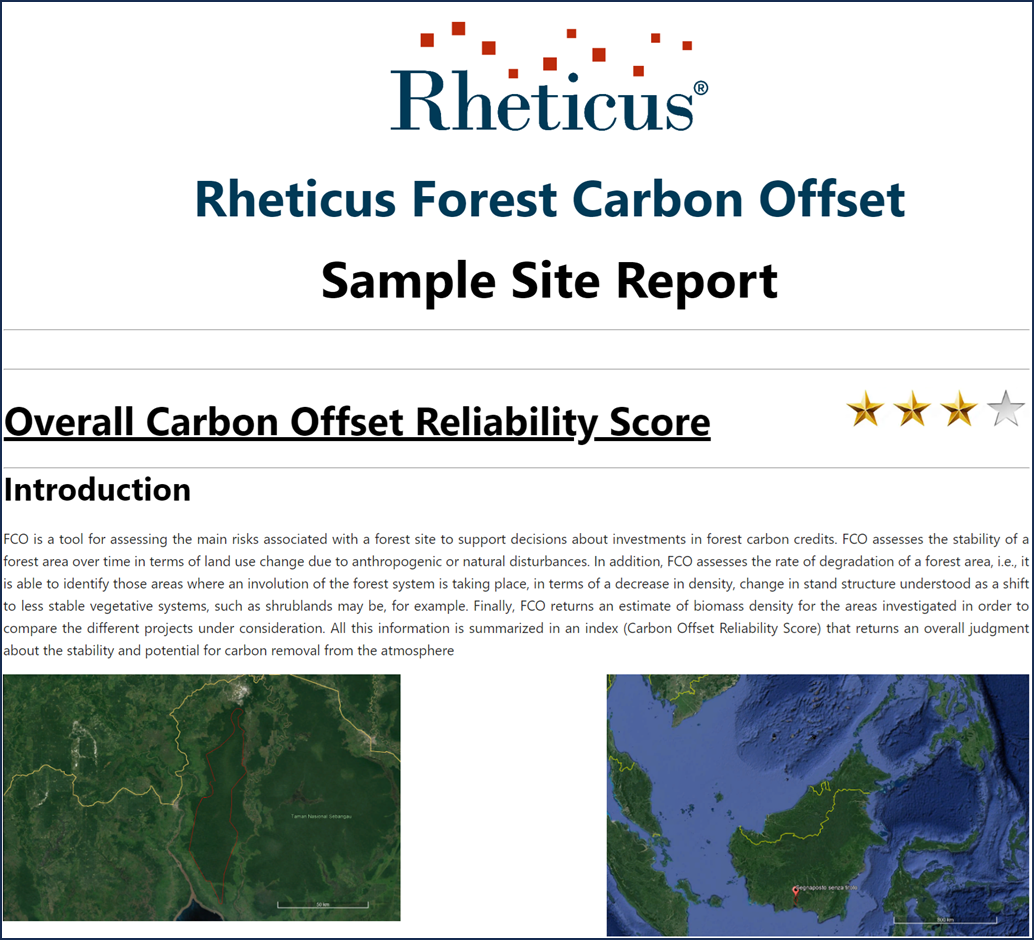

The service outputs an on-demand site report on an area provided by the user. A star-based rating is provided, whose accuracy depends on the accuracies of the weighted indicators based on the EO space assets used.

Current Status

Potential customers from the energy and consultancy sectors have been involved in improving customer identification and the definition of the value proposition.

The technical feasibility of the proposed service has been assessed by identifying critical technical and operational elements. A prototype of the report for the user containing the reliability score of the project and other useful information has been realised (see image above).

Planetek Italia also interacted with other stakeholders – carbon credit project certifiers, financial institutions, and academic experts – and collected information about pricing and business model viability to assess the commercial viability of the service.

All the elements collected contributed to elaborate a proof of concept, in which the critical assumptions about the customer desirability, technical feasibility, and commercial viability of the operational business have been tested and validated with potential customers.

Finally, a roadmap towards future developments and entry into the market has been defined.