Objectives of the service

Natural disasters, and specifically volatile weather events, are increasing in both frequency and severity due to climate change. Swiss Re estimate that in 2020, natural disasters generated $190 billion in economic losses.

These volatile weather risks adversely impact businesses and individuals across a variety of sectors. This ranges from agriculture, to property, to special events.

BirdsEyeView harnesses satellite-derived meteorological data to structure innovative parametric weather insurance products. These insurance products pay out when a pre-determined excess rainfall event occurs. Event organisers then purchase this insurance to protect their financial exposures against adverse weather.

The Special Event market would benefit most of BirdsEyeView’s innovative parametric weather insurance product. Not only does this market provide the largest market opportunity, but event organisers’ revenues are highly exposed to unfavourable weather conditions.

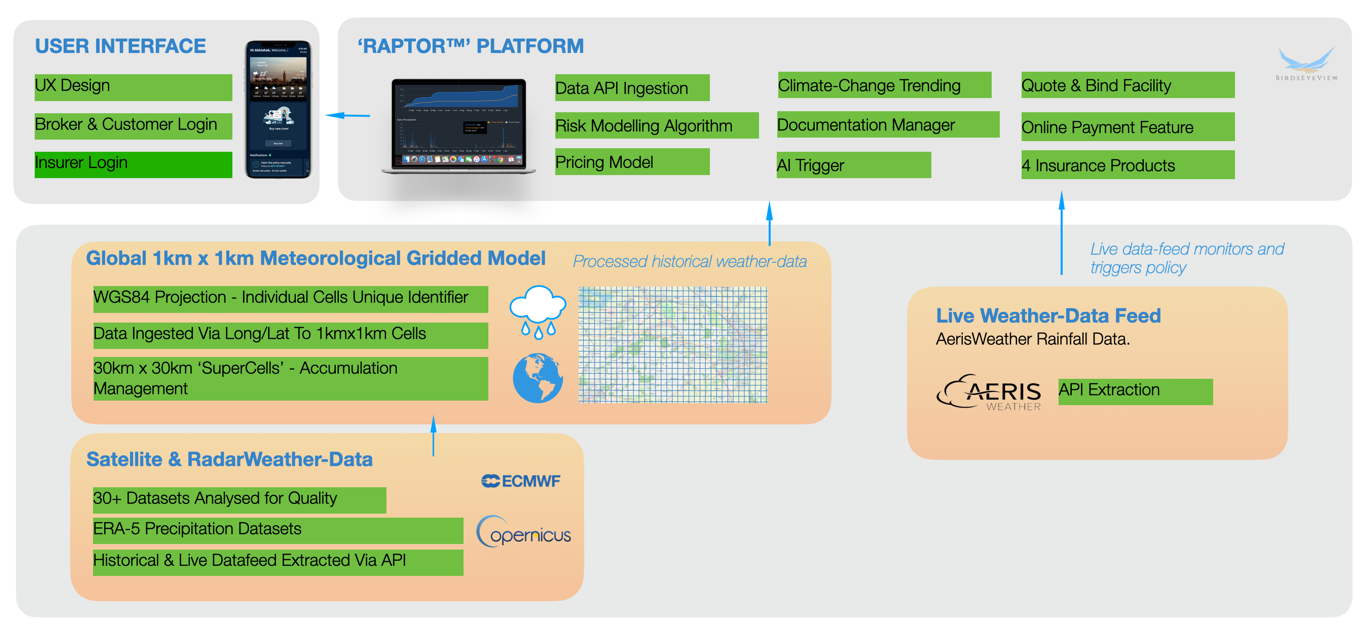

This product is delivered alongside Special Event insurance in an online platform called RAPTOR™. Insurance brokers use RAPTOR™ to quickly and efficiently structure and sell these Special Event & Parametric insurance products to their customers across the event organisation sector.

Users and their needs

Event Organisers (end-customer)

Event organisers are financially exposed to the impacts of increasingly volatile climate-change induced adverse weather events. Unfavourable weather can result in enormous reductions in revenue, and traditional event cancellation insurance will not indemnify these event organisers in the event of adverse weather. Event organisers need insurance that offers protection against adverse weather.

Insurance Brokers (direct customer)

Meanwhile, for smaller event organisers paying <€5,000 on their insurance, it is not cost efficient for insurance brokers to manually handle the policies and place them on an individual basis with underwriters. Therefore, an online tool that insurance brokers can use to quick place Special Event insurance is needed.

By distributing through insurance brokers who use RAPTOR™, BirdsEyeView will be targeting event organisers across the UK, Europe, and the US.

Service/ system concept

BirdsEyeView RAPTOR™ drastically reduces the time and associated manpower costs of placing these insurance policies manually and ensures that event organisers financial exposures to adverse weather are protected.

BirdsEyeView’s use of satellite-derived weather data, enables brokers to offer their clients across the event organisation sector, an innovative new parametric weather insurance product. This parametric weather product makes an immediate payout should a predetermined excess rainfall event occur, and without the need for loss adjustments.

BirdsEyeView has built an online algorithmic underwriting engine called RAPTOR™. RAPTOR™ harnesses space-derived meteorological data to structure innovative parametric weather insurance products.

Insurance brokers use RAPTOR™ online to offer their clients across the event organisation sector, Special Event & Parametric insurance products.

Space Added Value

BirdsEyeView extracts satellite-derived meteorological data from the ECMWF. Specifically, the ERA-5 weather data set is extracted, via API, from the Copernicus Hub. BirdsEyeView processes this historical weather data in order to structure its innovative parametric rainfall insurance products for the Special Event market, protecting the financial exposure events face to unfavourable weather conditions.

Traditionally, parametric weather insurance products have used weather data extracted from the nearest available ground weather-station. This presents a variety of issues, most pressing being data unavailability, poor spatial resolution, and low temporal resolution.

By using meteorological data extracted from satellite sources, BirdsEyeView has access to 43 years of high-resolution weather data, on an hourly basis, with global coverage. Not only is this data freely available, but it enables BirdsEyeView to distribute its insurance products globally and the resolution of the data improves underwriting performance.

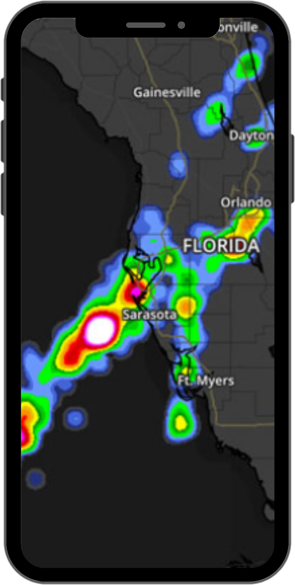

BirdsEyeView uses hyper-local weather data from a third-party weather data provider, extracted via API, for monitoring claims at insured locations. It is required by the insurance regulator that an independent third-party provider is used for claims monitoring as this prevents the potential for a conflict of interest arising. The weather data provider selected delivers near-real-time meteorological observations with a minimum 100m resolution for the aviation, ground transportation, and renewable energy sectors. They aggregate weather data from satellites, radar networks, and their own ground weather observation stations deployed at airports for air-traffic control purposes.

Current Status

BirdsEyeView has completed a Feasibility and has developed a beta version of its proprietary online algorithmic underwriting engine called RAPTOR™.

Throughout the Feasibility Study, BirdsEyeView provided RAPTOR™ to 6 insurance brokers operating across the UK, Europe, and the US. The insurance brokers provided feedback and the technology was iterated in response.

These 6 insurance brokers will participate in a follow-on Demonstration Project in which the product will be fully deployed in a commercial environment.