Objectives of the service

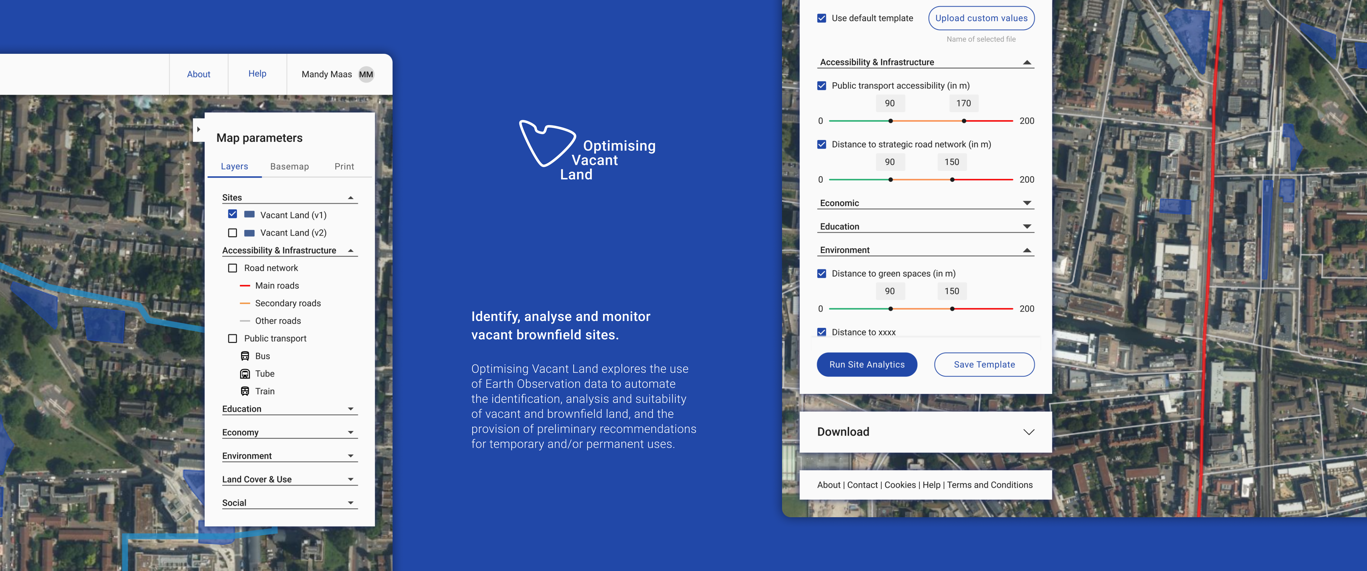

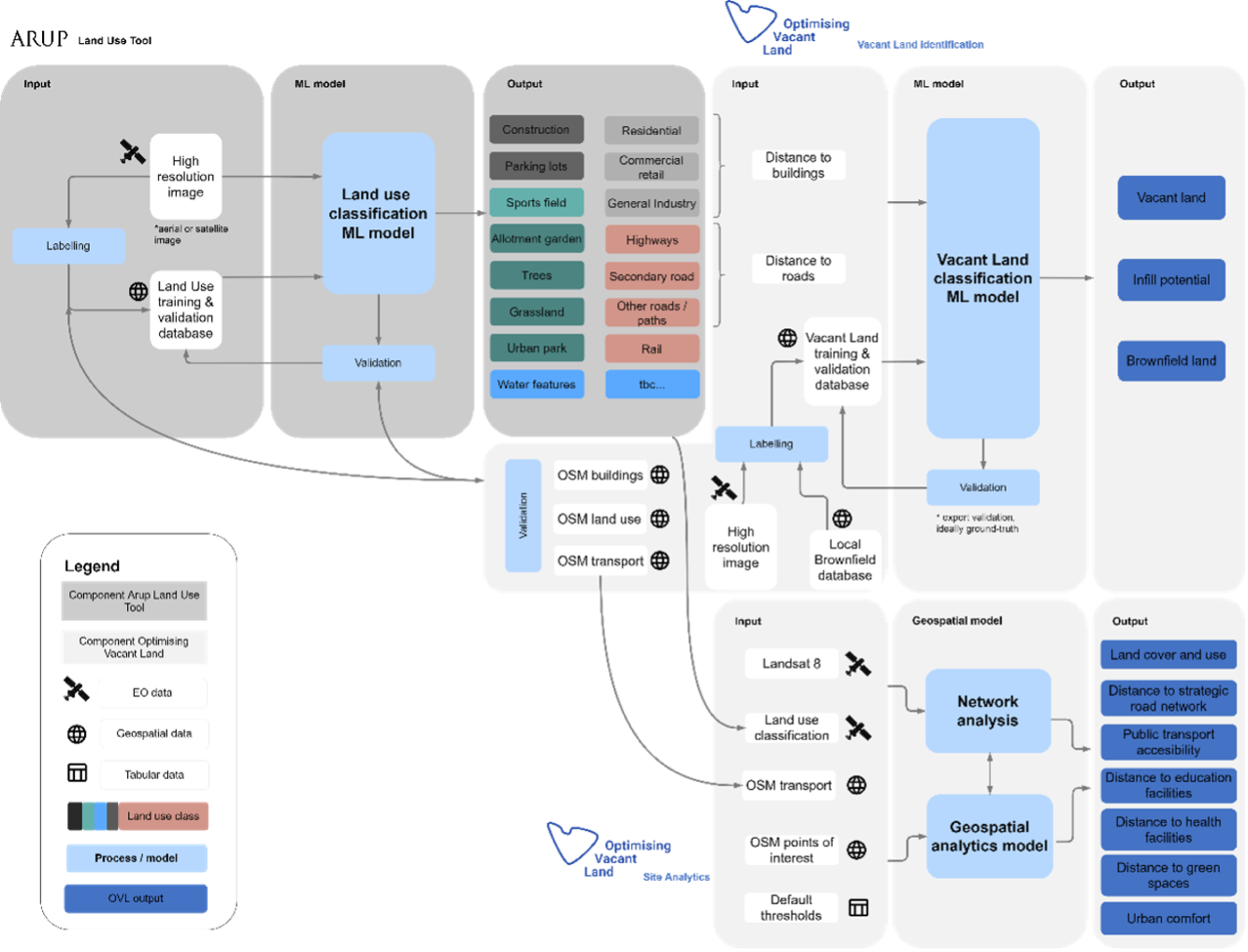

Optimising Vacant Land (OVL) looks at vacant, underutilised and brownfield land and how they provide an opportunity to create transformative interventions that contribute to addressing urban challenges and enhance the resilience of cities. The service explores the use of Earth Observation satellite imagery to automate the identification, analysis and suitability of vacant land, brownfield land, and the provision of preliminary recommendations for temporary and/or permanent uses.

The service aims to match the supply of vacant land with temporary or permanent uses based on development project aspirations and impact potential (e.g. economic, carbon, biodiversity, social value etc.) compared to leaving the land unused.

Users and their needs

The Optimising Vacant Land service targets two primary user groups:

- Local authorities (including sub-contracted consultants). These users can use the service to help with the identification and quantification of vacant sites. Additionally, the service will provide in-depth insights on site potential considering economic, social and environmental benefits. These users can use insight from this service to inform and shape local policies.

- Developers and meanwhile use providers. These users can use the service to identify possible (shortlisted) vacant sites for their specific uses considering selected constraints, and to monitor performances of a site once the use is in-situ.

The service addresses current user pain points around:

- Identification of vacant sites – currently this is a manual, labour-intensive process, and there is no consolidated register of vacant sites;

- Analysis of vacant sites to determine best site for a specific use – collating datasets, often with additional challenges around accessibility and quality, is effort heavy;

The feasibility study has engaged UK-based user groups and considers global applicability of the service.

Service/ system concept

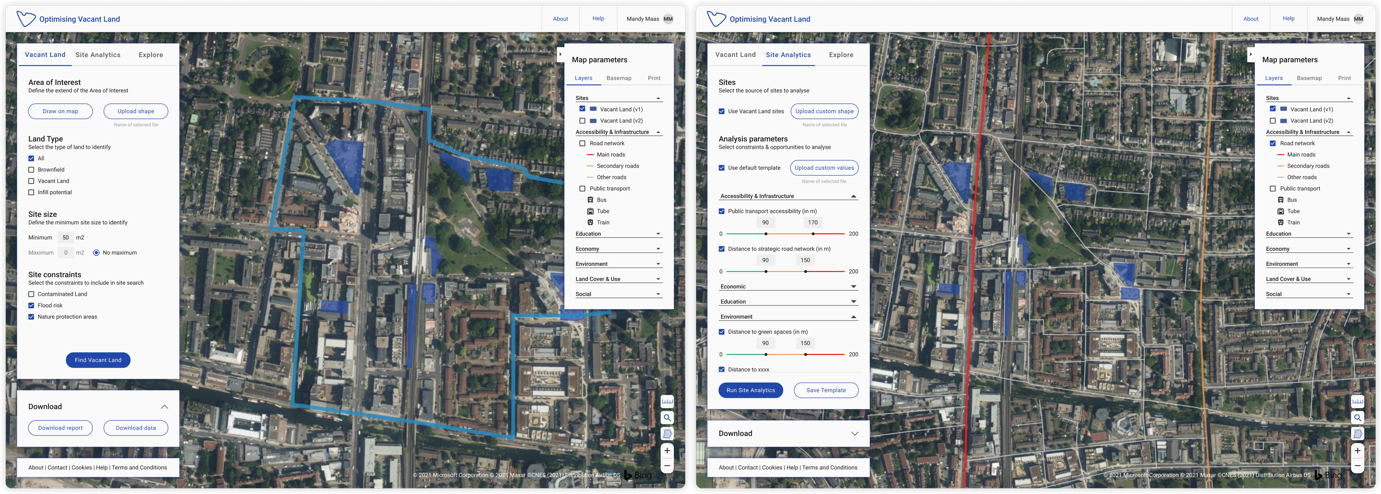

The service is built around two core modules which are accessible to users via a web-interface, Vacant Land and Site Analytics.

The Vacant Land function allows users to find vacant land based on criteria they define such as extent of their area of interest, type of land to identify, size of the area, and site constraints to include in their search. Once all the parameters have been entered, users have the possibility to download the results as a report or as data.

The site analytics module of the OVL service is focused on deriving in-depth insights of site parameters across: accessibility & infrastructure, economic, education, environment, land cover & use and social. When using the tool users can look more closely at identified sites. Users have the possibility to upload custom shapes or use sites previously defined in the Vacant Land tab. Then, they can select constraints and opportunities to analyse and define values for each.

Space Added Value

Currently no service identifying vacant and underutilised lands exists. The use of space data offers a new approach for site analytics, which can inform on novel parameters not currently considered in urban applications e.g. Urban Heat Island (UHI). More importantly this approach means the service can mitigate current stakeholder challenges such as the inaccessibility of some sites, or the resource intensive nature of site identification.

Current Status

To explore the technical and commercial feasibility, the project team has drawn on expertise from within Arup. Additionally, they held interviews with the Greater London Authority and meanwhile use providers in the UK. These interviews, combined with a literature review enabled the team to identify user requirements for the service. In parallel to this, they defined a concept architecture, and worked this up into a system specification and design.

For the commercial feasibility, the team has worked on defining customers, users and potential revenue streams. After in-depth assessment of the market potential, technical feasibility and interest in the service, the team has come to the conclusion that the service isn’t worth further investment due to:

- The timing of the planning cycles

- Complexity of planning ecosystems, including usage rights

- The size of sites that will attract the service may not be sufficient to guarantee a return

If the route to market becomes clearer the service may be picked up again in the foreseeable future.

The Final review was held on the 23th July 2021