Objectives of the service

Ibisa is a new decentralized marketplace for mutualized index-based risks linked to crops, geographical locations and environmental conditions designed to reduce the exposure of smallholder farmers around the world.

Users and their needs

Millions of smallholder farmers around the world are unable to access the quality services they need to compete in the global marketplace. 500 million agri-entrepreneurs are under-insured and exposed to financial distress. This represents 99.3% of low income farmers in the 100 poorest countries.

The inadequacy of today's insurance products is due to many factors, including insurance coverages that seem unrelated to the risks covered, the high price of premiums, and the obstacles and delays to pay claims.

Micro insurance is also subject to the pains of the cost and lead time to collect fees, evaluate the claims and settle payments due to processes that are designed for much bigger unit contracts. The market penetration of micro-insurance in developing countries is under 1% even when heavily subsidized.

This leads to an inadequate product offering that leaves millions of farmers exposed to weather related risks without compensation for loss. Lack of coverage constrains access to finance and quality agribusiness products and services.

Target regions: Africa, Latin America and Asia Pacific

Service/ system concept

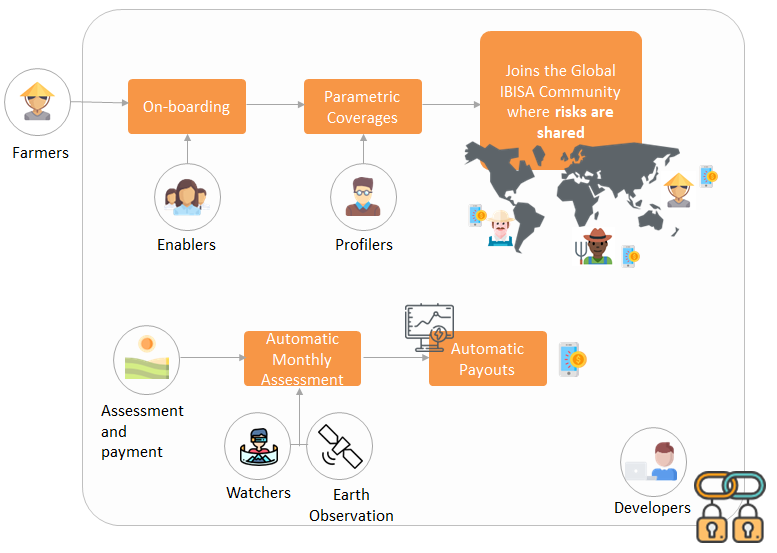

IBISA mutualizes index-based risks and works best with a large number of Users (farmers) distributed across different weather zones.

We work with Enablers (MFIs, local grocery stores, mobile money, local governments, insurers, NGOs etc.) to reach the users and on board them onto ibisa.

Profilers (or actuaries) create a portfolio of risk sharing products most suited to each farmer community, region and type of crop.

We rely on Watchers around the world to assess the damages and validate claim payment.

And last, but not least, a community of Developers create, improve and evolve the ibisa marketplace. This includes providers of actionable, satellite-based earth observation products that support index-based risk coverage.

Space Added Value

Unlike traditional insurance, which assesses loses on a case-by-case basis and makes payments based on individual client’s loss realizations, Index-Based Insurance (IBI) offers policy holders a payout when a measurable indicator (such as soil humidity) triggers a payment to insured clients within a geographically defined space. Earth Observation products, ‘tuned’ to the requirements of ibisa play a key role in the provision of index-based coverage.

Current Status

As of March 2018 ibisa has mapped user requirements and secured the support of over 12 key Enablers in Africa and South East Asia. The development of the ibisa marketplace is well underway and we are securing investor support to launch ibisa in the very near future. Stay tuned!