Objectives of the service

YouTube videolink: https://www.youtube.com/watch?v=KU7ropnY1GA

Adverse weather events significantly impact smallholder farmers and associated businesses, leading to diminished or lost harvests and financial distress. IBISA addresses these challenges by offering tailored, cost-effective climate insurance solutions. We use satellite data monitor critical weather parameters like rainfall, wind speed, and temperature. This allows us to design transparent insurance policies, bypassing the need for time-consuming and resource-heavy physical loss assessments. Our approach results in quick and fair claim settlements. Furthermore, in partnership with insurers and distribution channels, we're able to scale our services and enhance our insurance product offerings. Thus, through our technologically advanced, partnership-driven approach, we provide robust, efficient, and scalable solutions to mitigate the financial impacts of climate change on affected communities.

Users and their needs

Climate change poses severe risks to smallholder farmers and related businesses. These communities often suffer financial losses due to adverse weather conditions affecting their harvests, causing a ripple effect on the larger ecosystem that includes input dealers, financial institutions, and food companies.

IBISA, a global climate insurtech, utilises satellite data to create tailored insurance solutions that not only benefit the smallholder farmers but all others connected in this ecosystem. This cost-efficient and scalable approach provides protection against climate risks, ensuring financial stability in the event of weather shocks.

Service/ system concept

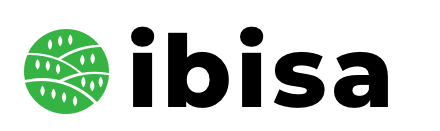

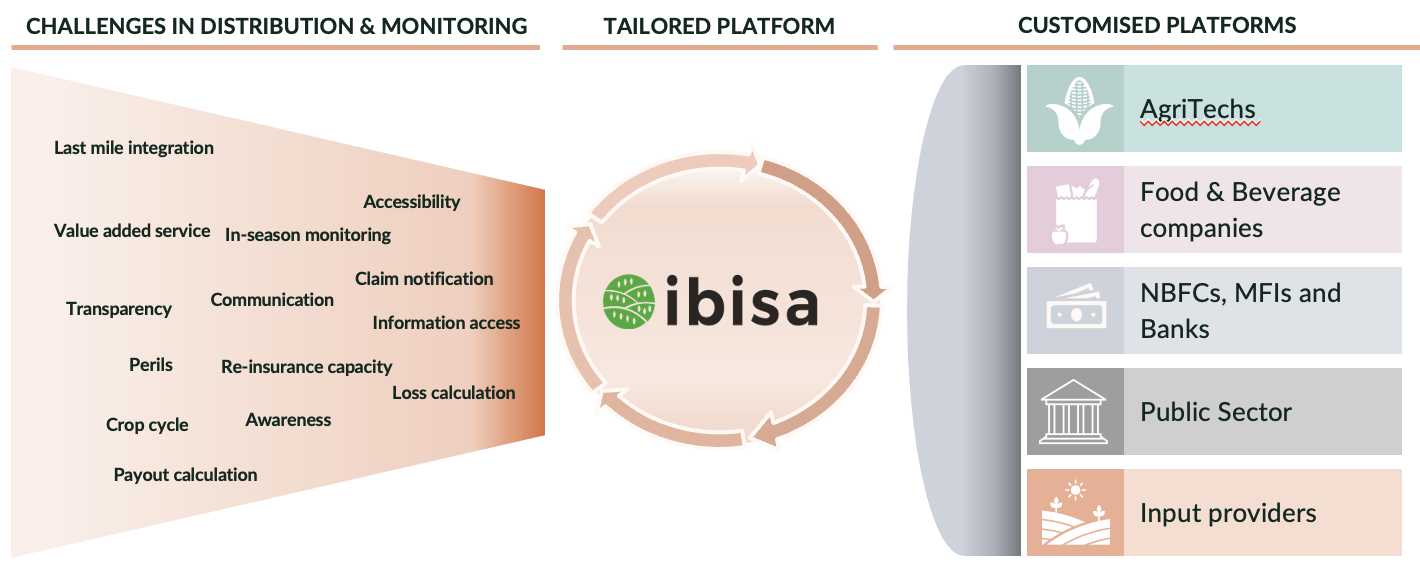

During the project, IBISA team successfully developed an end-to-end platform dedicated to the design, distribution, and operations of satellite index-based insurance. This comprehensive platform effectively addresses all aspects of climate insurance, offering a cost-efficient and scalable solution.

The centrepiece of our service is a system comprised of three fundamental building blocks:

1. IBISA Earth Engine: This powerful module handles various essential tasks, including downloading, controlling, processing, and analysing weather and climatic data.

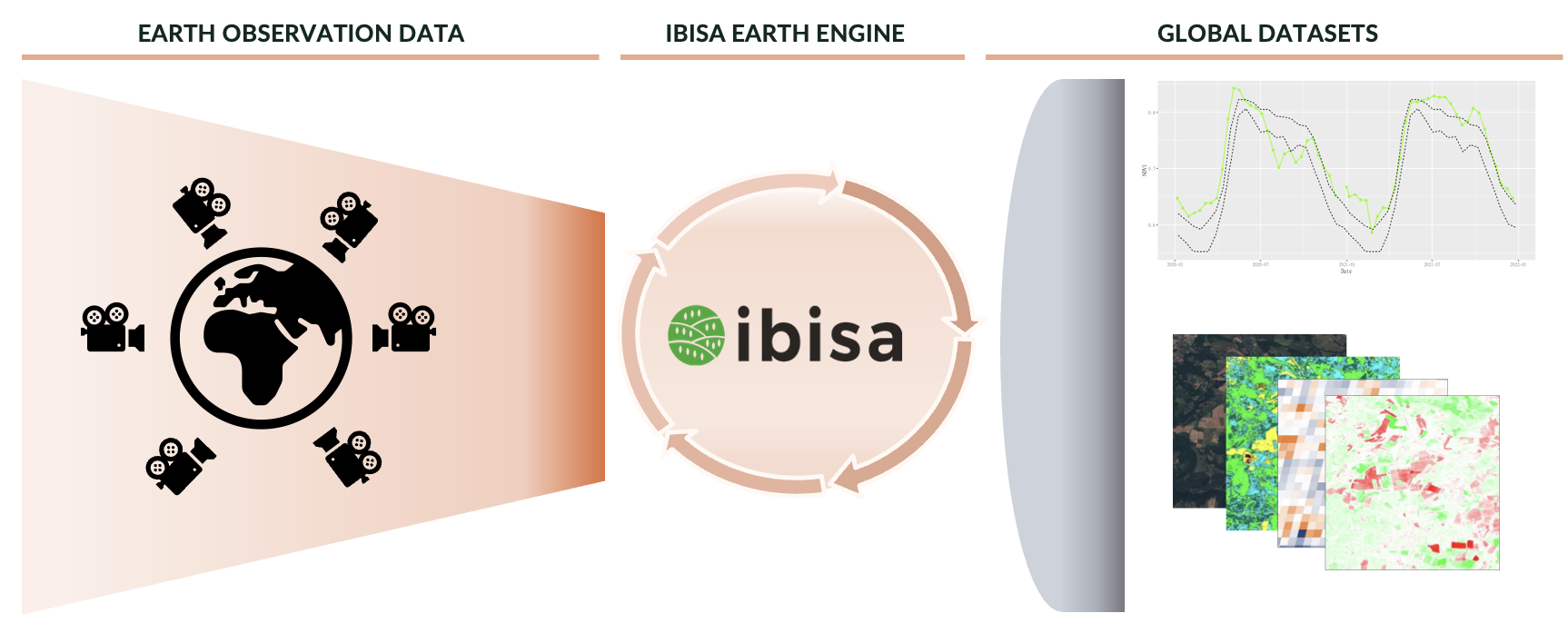

2. IBISA Risk Modelling: this component enables the swift and scalable design and pricing of insurance coverages.

3. IBISA Policy Management: this module serves as a centralized platform for policy distribution, monitoring, and operations. By utilizing this module, our customers gain comprehensive control and oversight over their policies, streamlining the administrative processes involved.

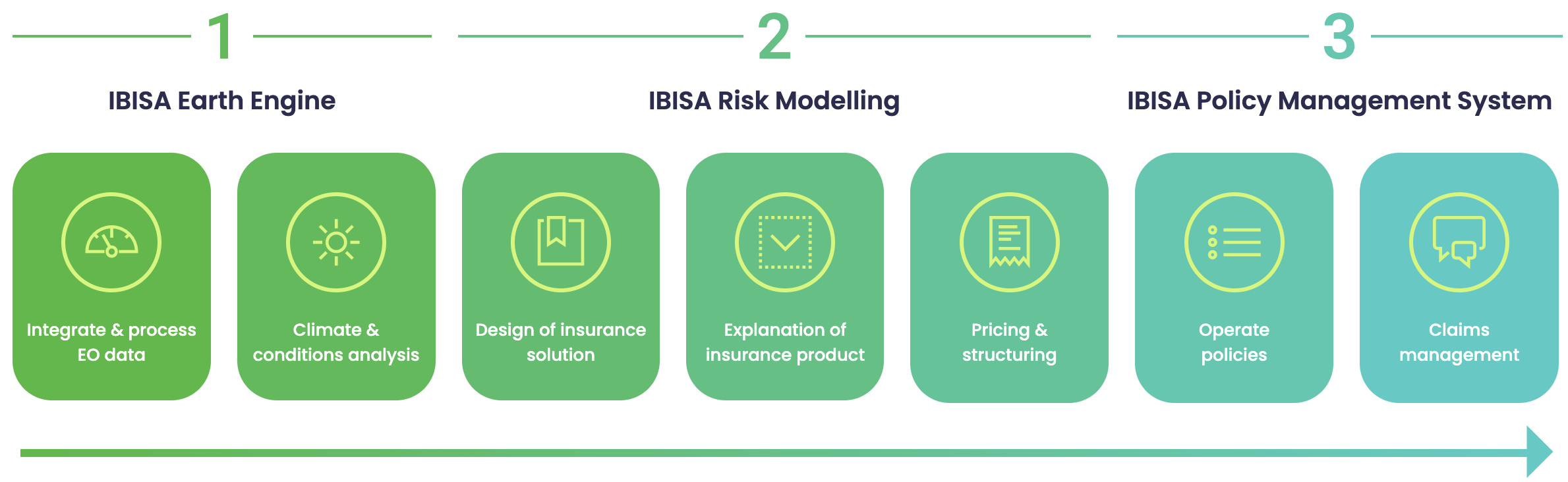

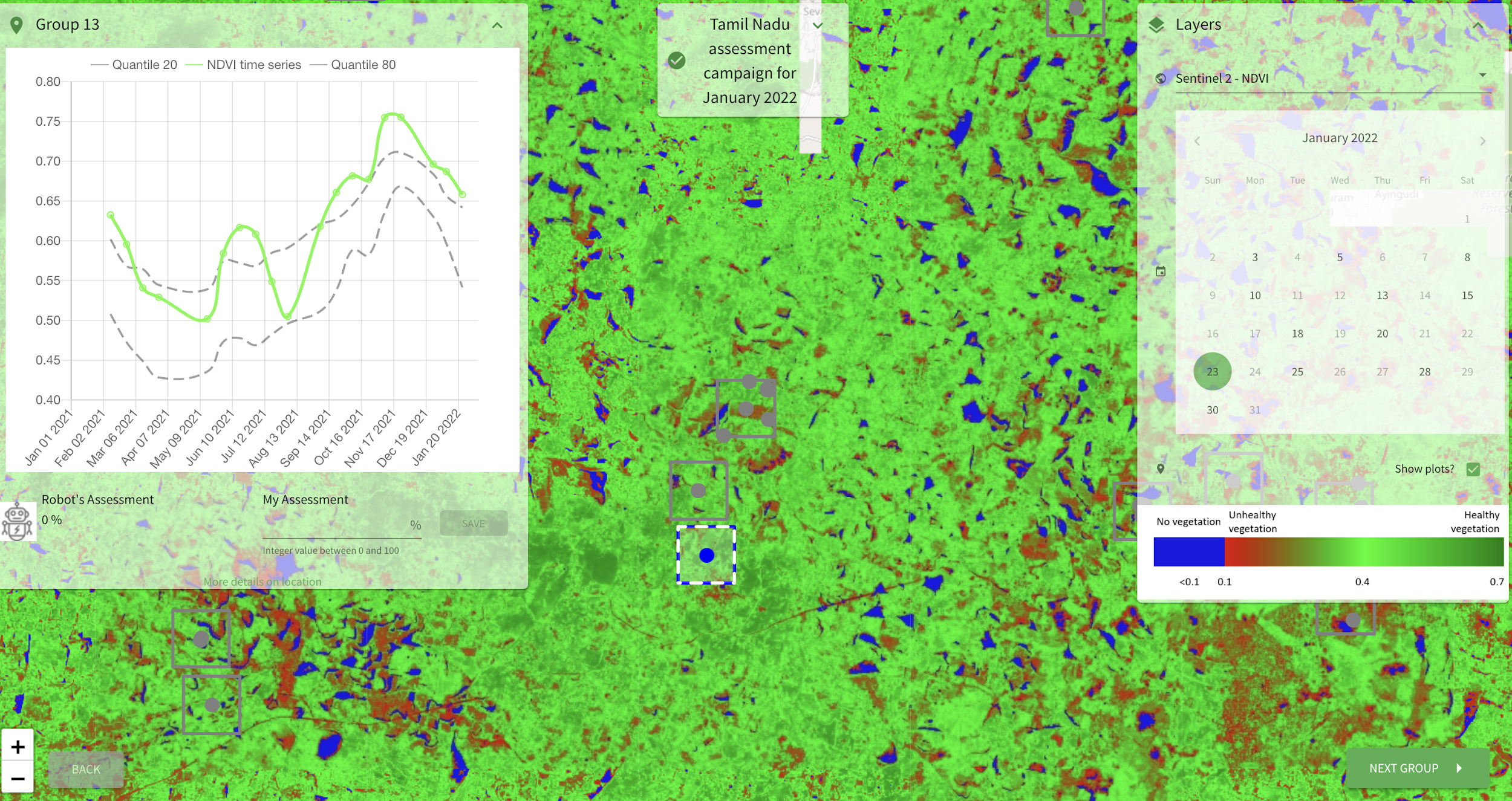

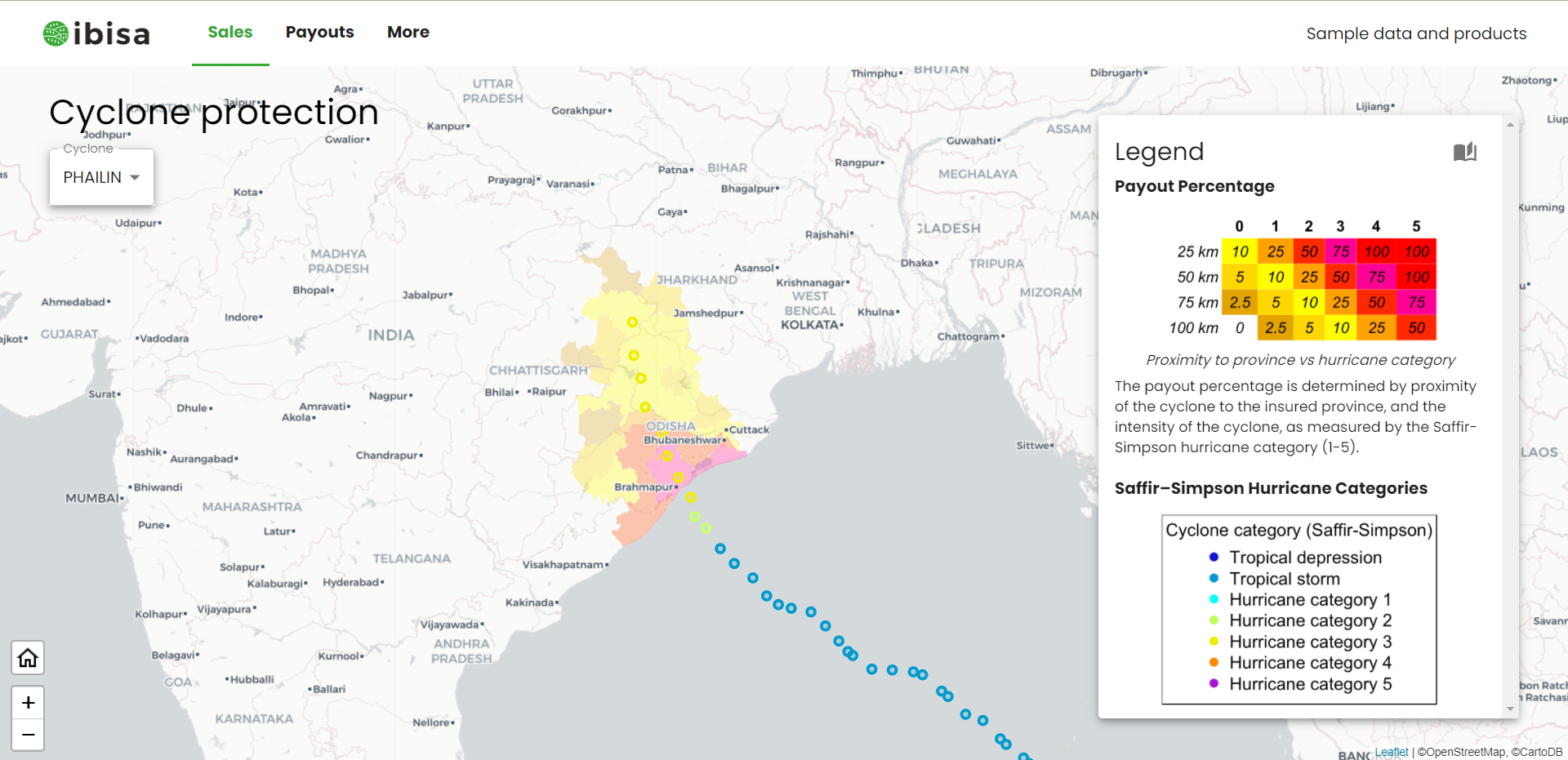

Space Added Value

IBISA uses satellite data to gauge essential weather parameters, forming the cornerstone of our insurance solutions. This data, processed through our proprietary IBISA Earth Engine, eliminates the need for physical assessments, speeding up claim settlements and ensuring fairness. The use of diverse satellite data helps us design accurate insurance products. Furthermore, space data allows seamless geographical scalability of our solution. Thus, our space-based approach gives us a distinct advantage over traditional methods, providing robust, efficient, and globally scalable insurance solutions.

Current Status

The demonstration phase has been finalised with significant growth in technology, partnerships, and geographical reach. We conducted pilots in three distinct markets - India, the Philippines, and Senegal, validating our solution across diverse conditions. Currently, we're focusing on enhancing our service delivery while initiating our commercial services, particularly in India. Our immediate future objectives include extending our services to other potential markets.

Here are some snapshots from different stages of the project, capturing moments across various locations. These pictures not only illustrate our progress but also highlight the diverse communities and partners we've had the privilege to work with. We hope these images provide a sense of the challenges we've overcome, the milestones we've reached, and the impact we strive to make.

Field visits for requirements gathering in Gujarat and Odisha, India.

Product design workshops with DHAN in Tamil Nadu, India.

Community of Practice workshops in the Philippines

Onboarding session in Senegal

Payouts ceremony in India

IBISA booth during India’s National Dairy Development Board Event in the context of G20. Below in the picture of the Minister of State for Animal Husbandry, Dairying and Fisheries of India,

Mr. Parshottam Rupala visiting the IBISA stall.

Here is a short case study of our dairy product: