Objectives of the service

The service concept focuses on the loss detection and loss estimation in forest areas after storm events or forest fires. The targeted pilot users from the insurance industry need a service that has the potential to support the claims management process in a way that in-situ assessment of damages can be reduced to a minimum. Another aspect is the status monitoring of insured and not yet insured forest areas that allows for negotiating appropriate contract conditions with the policyholders. The service concept covers a continuous monitoring together with an in-depth analysis after loss events that will be provided through a geographical information system (GIS).

Users and their needs

The targeted user communities are insurance companies working in thematic domains that are appropriate for satellite-based claim assessment. During the requirements analysis phase, one main use case emerged, which covers the claim assessment for forest insurance. The main users’ needs within this use case are:

- Claim management: identification of location, size and degree of destruction for affected areas after storm event

- Status monitoring of forest areas for pre-disaster information

- Plausibility checking of loss notifications

The operational challenges trying to meet these needs are:

- Appropriate cost-benefit ratio

- Procurement of cloud-free optical data

Integration of additional stakeholders

Currently, the service is focusing on Germany.

Service/ system concept

The information delivered to the user consists of two parts: the first one is a monitoring service that allows for continuous change detection in the relevant forest areas. The second component is an in-depth analysis of affected forest areas after a storm event.

The information is delivered in form of geographical web services, which can be either exploited through a dedicated geographical information system (GIS) tailored for the project or visualised by easy integration into an existing GIS.

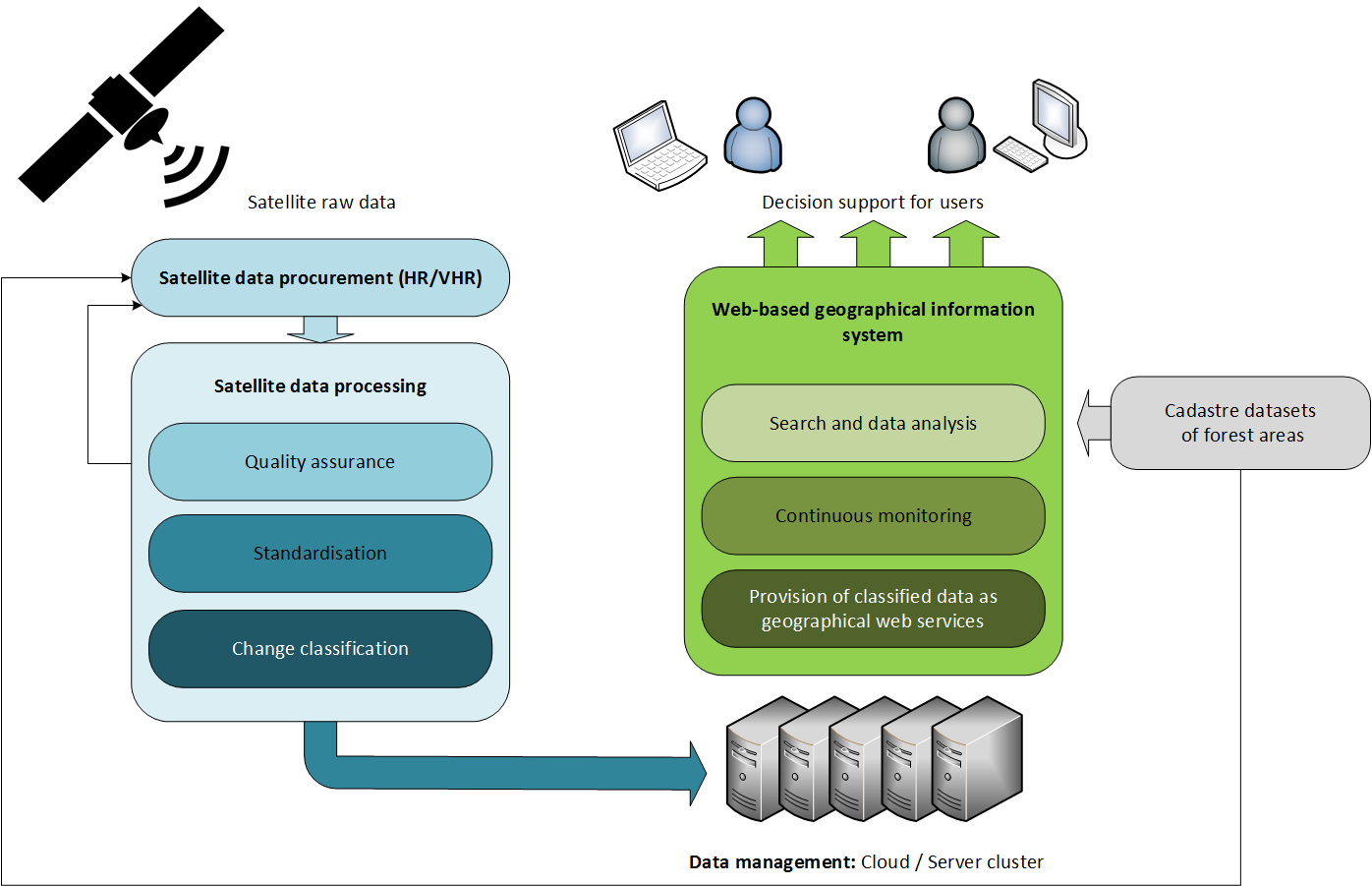

The figure below shows the high-level system architecture including the main system building blocks. The service value chain is covering all aspects of the system, starting at the procurement of the raw satellite data, via the data processing and storage up to the provision of services and comprehensible user interfaces that allow for exploitation of results and key decision support for the end users in the claim management domain.

Space Added Value

The space assets used in the project are earth observation and satellite navigation (GNSS). The use of earth observation data allows for an all-area overview of losses after a large-scale disaster. This is especially important for the management as well as for the responsible persons steering the claim assessors in the field. An area-wide but also detailed loss classification allows for plausibility checking of incoming claim notifications from policyholders. A constant monitoring allows for change detection, which is also relevant as pre-disaster information.

Satellite navigation supports claim assessors in the field in finding loss locations that were detected via the EO based service and need further examination. In addition, GNSS allows for precise geo-referencing of detected damages in the field.

Current Status

The contact to the user community within the insurance industry has been successfully established. Several workshops have been organised to gather the user requirements and to discuss the service concept. Based on this information, a detailed user requirements analysis has been provided. In parallel, an economic viability analysis has been conducted. A Proof-of-Concept activity has been realised to demonstrate the benefits of the service concept to the target users. Additional stakeholders from the forest domain have been approached and are committed to participate in a proposed demonstrator project. It can be stated that the feasibility study has been concluded successfully. The main objective was achieved: demonstrating the technical feasibility and the economic viability of the proposed solution for the insurance industry.