Objectives of the service

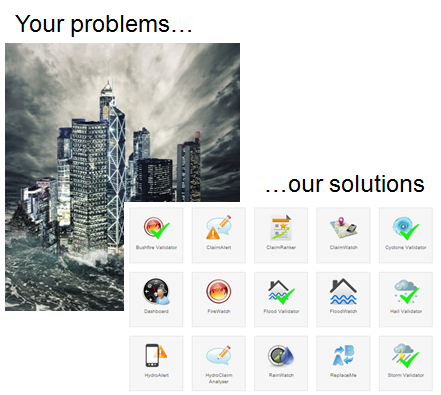

The objective of this feasibility study is to assess the validity of the InsureApp service consisting of a range of applications to support the insurance industry with a novel approach of interaction between insurers and their clients before, during and after natural hazards, in which provision of warnings and feedback collection from policy holders form an integral part of the service.

Users and their needs

The user community for the InsureApp Service includes all relevant users in the general insurance and reinsurance value-chain concerned with the assessment and management of claims arising from the occurrence of major natural disasters and man-made events, e.g. insurance and reinsurance companies, loss adjustment professionals, industry associations, policy-makers and regulatory agencies

At the first instance the InsureApp service will focus on the Australian insurance market which includes 133 insurance companies. Numerous disasters occur in Australia, the populated areas are very sparse and poorly monitored and using satellite data might be very beneficial. For this reason, HydroLogic has made contacts with local partners which operate in the insurance business: Watertechnology, AusInsured and Royal HaskoningDHV. These companies are actively involved in the Feasibility Study and they might be the future distributors of the InsureApp service.

Service/ system concept

Earth observation data (soil moisture, land use, precipitation, evapotranspiration) and in situ data (rain and flow gauges) are collected and stored in databases in the Cloud. The following services are used to generate the required rainfall and flood information:

- The RainWatch service to create an area covered rainfall product based on rain gauge data, radar data and satellite data (via the Hydro-estimator)

- The FloodWatch service to develop flood maps for areas where there are no existing floods maps

The RainWatch and FloodWatch services validate the data and generate rainfall map of Australia and Flood maps. The information is made available the the Flood Claim Report generator application which is accessible by the insurance companies via the web.

Space Added Value

Satellite data plays an important role in the Flood Claim Report Generator Services. GNSS measurements will be used for geo-tagging photographic/video evidence and damage reports as input for the Flood Claim Report. Earth Observation is used to provide rainfall information in areas without radar-coverage. This satellite based rainfall information will be automatically calibrated with rain-gauge data and will be archived in databases. Based on the measurements of the nearest rain and flow gauge(s), the recurrence interval of the event and the available flood maps, the flood extent will be determined as input for the Flood Claim Report. All relevant data will be archived. This will give insurance companies the opportunity to generate Flood Claim Reports event months or years after the event.

Current Status

The project was finalised in January 2014.