Objectives of the service

In the last 5 years, re/insurance losses due to climate-related catastrophes summed up to about €320 billion. This is because the strategy re/insurance companies generally use to assess climate risk is outdated as it is based on the historical data alone, without accounting for climate change. However, most of the available climate data are too coarse to be adopted by re/insurance companies to assess climate risk at a relevant scale. The horizontal resolution necessary for local risk assessment is about 100 m, and none of the available data sources reach such a high resolution.

The NUA project is aimed to make AMIGOclimate – the innovative SaaS developed by Amigo for the re/insurance industry – the only solution on the market that supports local climate risk assessment over different time horizons. This is possible thanks to the seamless integration of EOs with reanalysis, seasonal forecasts and climate scenarios through an AI-based downscaling method to reach the spatial resolution of 300 m. As such, NUA offers a cost-effective solution to mitigate the risk of climate change in the re/insurance sector by accessing high-resolution climate data for past and future events.

Users and their needs

NUA targets medium and large re/insurance companies providing agricultural coverage and Property and Casualty (P&C) insurance as the main customers and users of the solution. In particular, we identify the departments within the insurance organisations to target as underwriting and actuarial, which are responsible for the risk analysis and the pricing of the products. Moreover, the corporate strategy is the department that makes strategic decisions of the overall business goals of the company. We identify this department as one in our interest because of their role of guidance within the company and hence in the position to select the company’s tools to assess climate risks.

The NUA solution needs to be integrated with the lifecycle of insurance products:

-

New product design: underwriters have easy access to innovative data, and/or the insurance company could outsource to the Amigo team the whole product design.

-

Constant monitoring: underwriters and actuaries have an easy-to-use platform for the constant monitoring of the meteorological conditions for the prompt identification of insured events

-

Mid- and long-term forecasts of climate risk: underwriters and actuaries have unique information for the management of policies and of the overall portfolio.

Service/ system concept

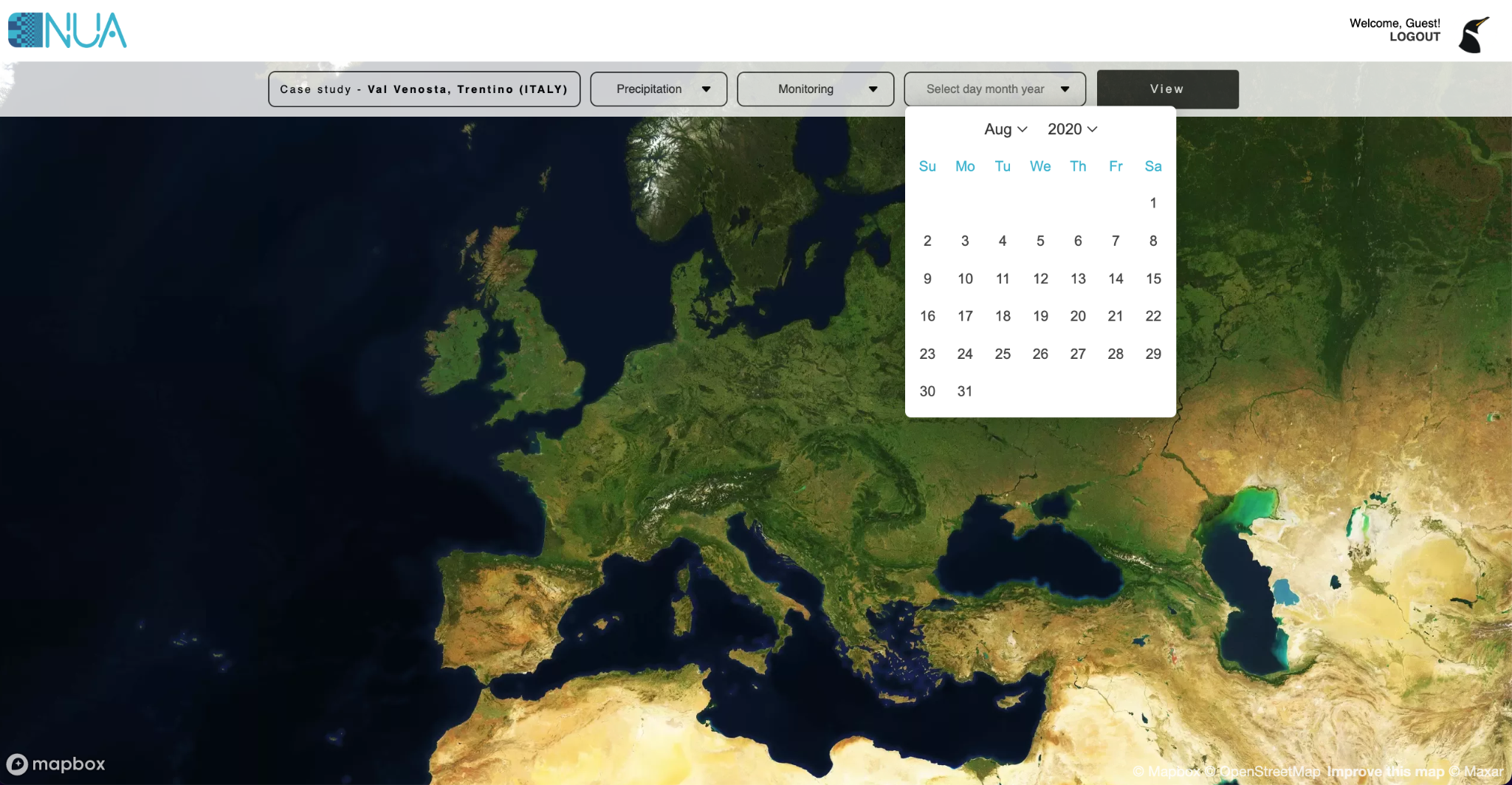

The NUA project aims at developing an innovative solution that provides re/insurance companies with climate risk data at a horizontal resolution of 300 m for past and future events. This is possible thanks to an AI-based downscaling method. To make the downscaled data available to the customers, we design the service architecture that includes a data centre, the downscaling engine, and a visualisation interface.

The service provides:

-

historical values of the variables and indices linked to the climate-related risks to evaluate the risk and price the products;

-

mid-term forecasts to understand the risks pinpointed by the climate indices over the duration for the next season (up to 6 months);

-

long-term predictions (for the next 5 to 10 years) to optimise the company strategy in view of climate change;

-

a visualisation interface for a user-friendly way to access information.

The NUA approach has been applied on three business cases: (i) late cold spells on vineyards in the Adige valley (Italy), (ii) droughts and excess of precipitation on orchards in the Venosta valley (Italy), (iii) the windstorm risk in the Finistère department (France). The business cases are designed with the customers engaged during the project.

Space Added Value

NUA exploits the data of Sentinel 1, 2 and 3 to describe the local characteristics of a geographic region such as vegetation and land surface. Earth observations are the added value of NUAA with respect to any other application based exclusively on reanalysis products and seasonal forecasts. In particular, this state-of-the-art data will enable us to:

-

account for the characteristics of a region with information only partially included in climate models;

-

provide high-resolution information about the climate risk, moving from 100 km to 300 m resolution;

-

assure continuity in the service for decades to come, given the long life ahead for the SENTINEL instruments;

-

contain the costs of the solution since the data are free to use and the exploitation of level-2 greatly reduces the time needed for row data processing.

Current Status

NUA has successfully completed the final review process and has now reached TRL 5.