Objectives of the service

Companies in the fast moving consumer goods and commodity sector are sourcing products from so-called smallholders (farmers with c. 2-3 ha of land), which have an important agricultural role as for example they are responsible for 80-90% of worldwide coffee and cocoa production.

In order to secure their supply and meet the growing demand for food, such corporates train and/or finance these smallholders. However financing is not their core activity and banks have been asked to assist. But banks (i) tend to act conservative as credit risk on smallholder is high.

To solve these challenges, we believe that satellite data can provide information which financial institutions can use for their risk assessment. For example on the location of smallholders and the historical to current quality of their crops, impact of management practices and long and short term threats to performance and environmental risks related to climate change, disease, drought and floods.

Instead of a case-by-case approach, we want to develop a uniform solution in order to create a maximum and efficient impact for every party involved. The proposed service supports (impact) investors and other stakeholders using integration of satellite remote sensing technologies and satellite positioning.

Users and their needs

Smallholders who are in need of credit

Service/ system concept

The proposed service creates investment opportunities and increases smallholder’s access to finance. It does this by combining EO derived information with farmer data from traders in a digital credit scoring card. Smallholders require relatively small loans and the investment risk is hard to estimate. The service provision value chain consists of using smallholder data already available at the traders which surpasses the need to assess every smallholder individually

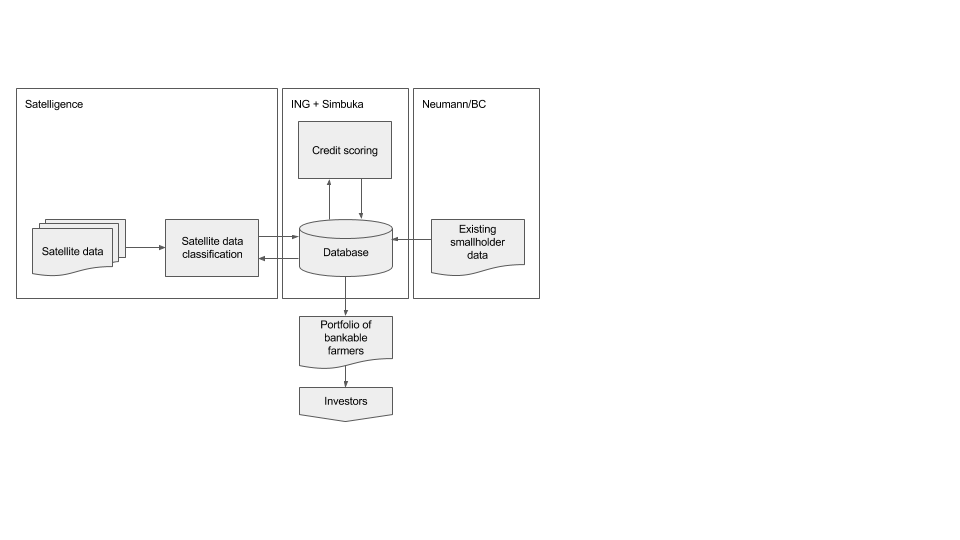

The information service consists of seven high level components shown by the figure above. Arrows indicate producer-consumer relations or information flows of which some can be highly automated in the future. The large background squares show which project partner is responsible for which components and which information flows. Flows going out of one large square, into another are the shared responsibility of both partners.

The portfolio is the end product (the main interface) going to the investors who are the end users.

Space Added Value

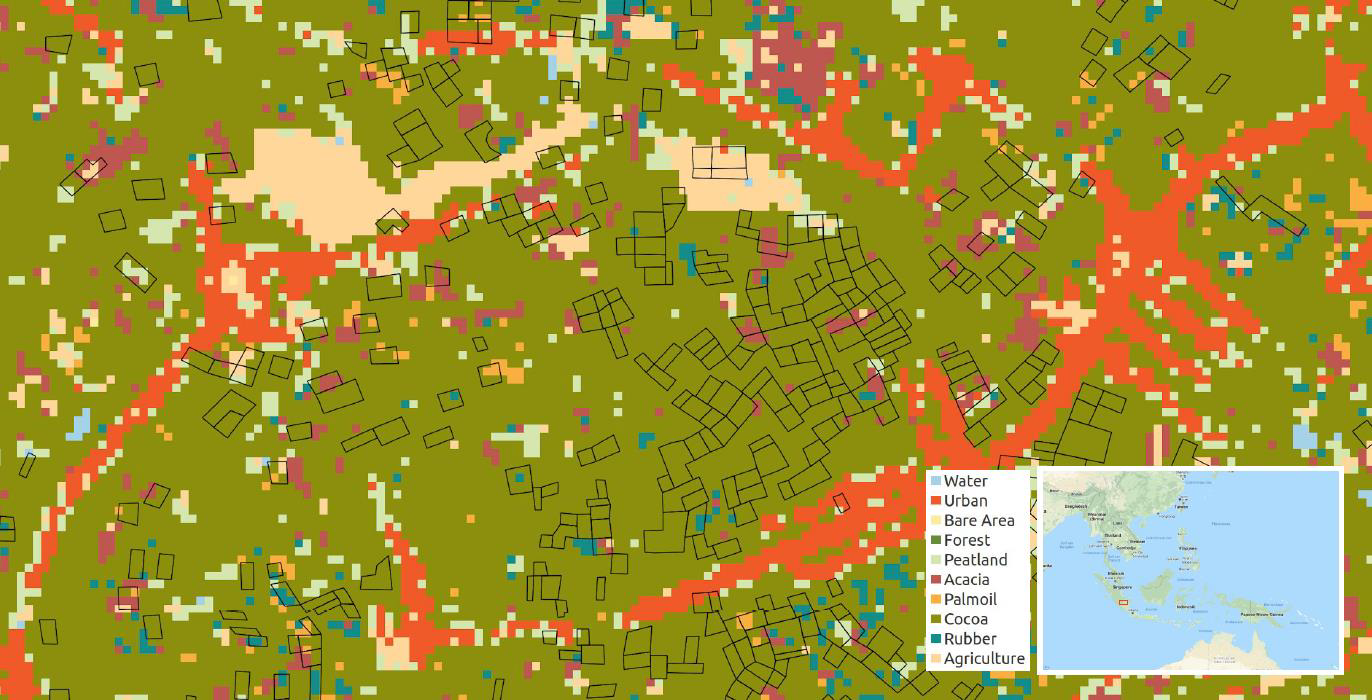

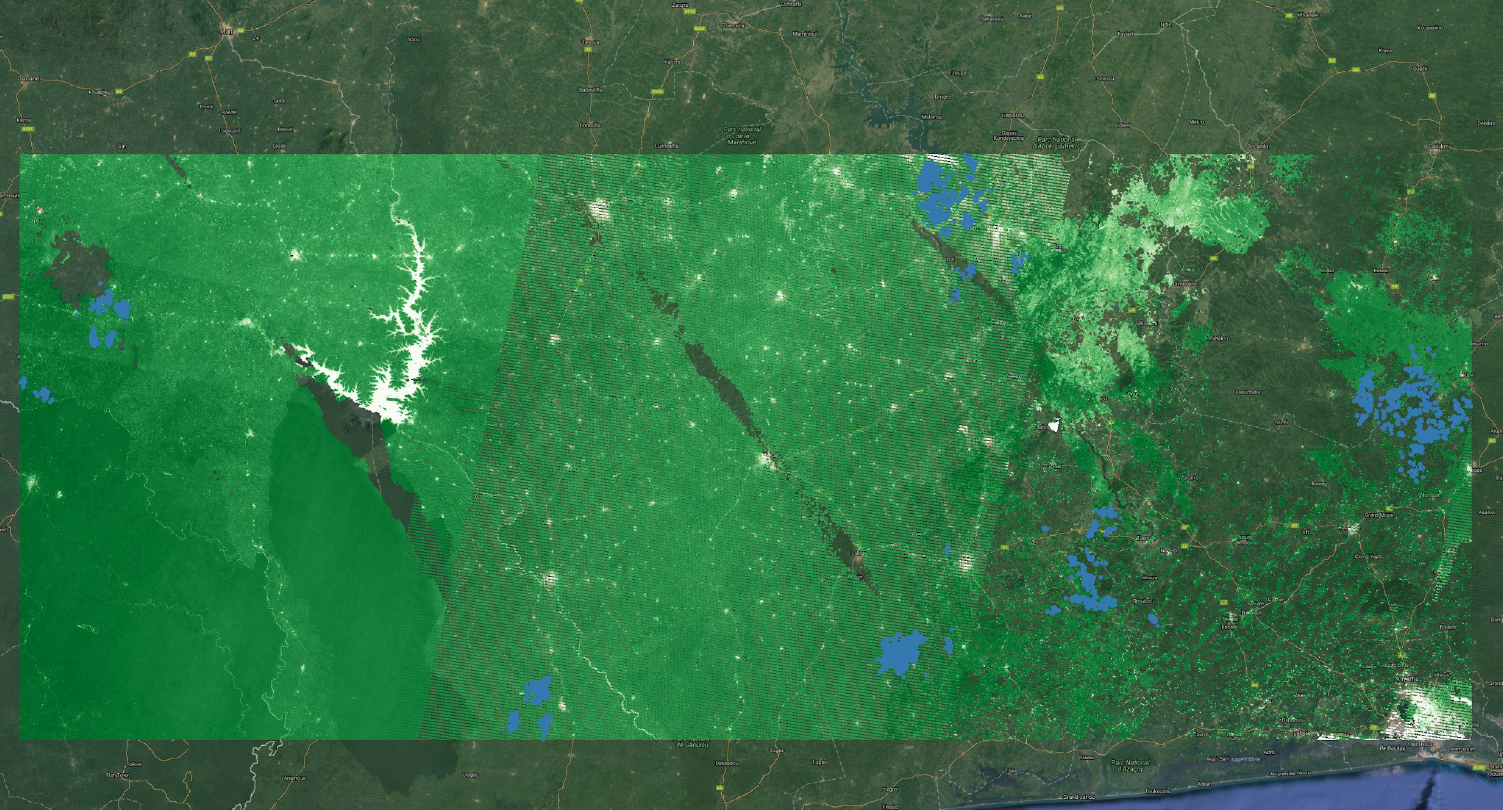

Information from traders alone is single-source and does not contain the required information for smallholders to be considered bankable. The satellite data is used to create crop maps like cocoa/coffee and performance information. Baseline data on plantation crop cover (number of trees, detailed plantation boundary) is based on Very High Resolution imagery (0.5 – 5m) collected on an annual basis. The pilot phase assesses the current data from Landsat, Sentinel-1,2 and MODIS to create information on crop location, performance and risks. By including data from the active sensor on ESA’s Sentinel 1, the cloud cover issue hampering dense time series generation during full seasons is alleviated. Long term time series of open data on rainfall and soil moisture at the district scale (e.g. TRMM, GPM, ESA CCI SM) is e integrated in order to assess climate change risk.

The satellite derived information is integrated in the digital credit scoring card as follows:

• It serves as the primary source of market risk data on droughts and floods.

• Coffee/cocoa map is used to verify trader/smallholder farm size data.

• The measured crop activity over multiple years is used to verify trader/smallholder data on yield and income by comparing it to the observed greenness.

• (optional) Map deforestation to measure and track forest sustainability for investors.

Current Status

Quality of the received data was poorer than expected and it took more time than foreseen to clean up, process the datasets and make them machine ready than the timeframe as set out for the 6 months of the Feasibility Study.

However based on the results so far, we still believe that remote sensing results contribute to determine the creditworthiness/productivity of smallholders and is among the 10-15 risk parameters of the credit scoring model. More time is needed to integrate and connect the remote sensing data with local collected data.

Next step is to integrate the results of existing systems/algorithms with the aim to see remote sensing features usable/relevant for smallholder credit scoring/productivity performance. This in order to identify the 10-15 parameters usable for credit scoring (including remote sensing ones)