Objectives of the service

Property insurance plays a crucial role in safeguarding the interests of property owners, insurers, brokers, and chartered surveyors. However, one persistent challenge that plagues this industry is the issue of underinsurance. Underinsurance occurs when the insured property's value is underestimated, leading to inadequate coverage in the event of a loss or disaster. To combat this problem and revolutionise the property valuation process, Intelligent AI has developed the Intelligent Rebuild Cost Platform, which leverages open data, commercial data, and Satellite Earth observation data. Supported by co-funding from the European Space Agency, under the ARTES 4.0 Business Applications – Space Solutions, this platform aims to provide faster, more accurate, and cost-effective property valuations, ultimately addressing the widespread problem of property underinsurance.

Currently over 80% of commercial properties are underinsured by up to 50% and through the innovative use of Satellite earth observation data, Intelligent AI are eradicating this issue.

Users and their needs

-

Property Owners: Underinsured property owners may find themselves facing substantial out-of-pocket expenses when they file a claim. They often discover that the coverage they thought was sufficient falls short of the actual costs required for rebuilding or repairing their properties.

-

Chartered Surveyors: Surveyors tasked with assessing property values are burdened with the responsibility of delivering accurate valuations. The Intelligent Rebuild Cost Platform helps surveyors to provide faster, more accurate valuations and to deliver portfolio assessments for larger clients.

-

Brokers: Insurance brokers are entrusted with the responsibility of ensuring their clients have adequate coverage. When properties are underinsured, brokers may face client dissatisfaction and potential liability for failing to secure appropriate coverage.

-

Leading Insurers: Insurance companies are affected by underinsurance as it can lead to higher claims payouts, reduced profitability, and increased customer churn. Accurate property valuations are crucial for pricing policies and managing risk effectively.

-

Global Solution: Intelligent AI's partnership with the European Space Agency is enabling us to use Satellite Earth Observation data to analyse properties globally. This means that the platform's benefits are not limited to a specific region, making it a versatile and scalable solution.

Service/ system concept

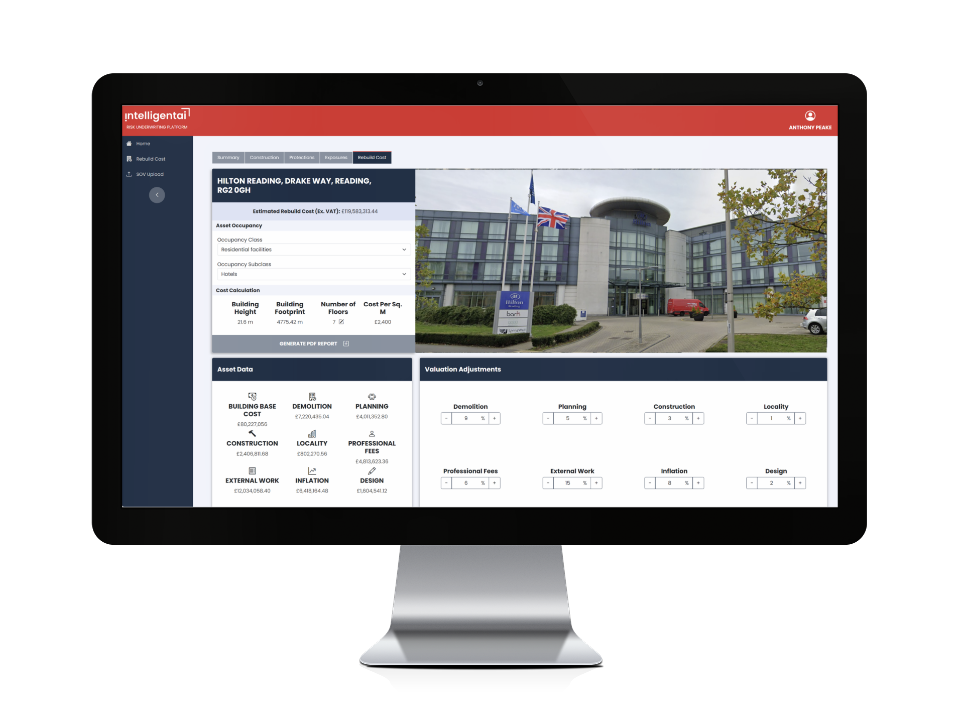

Intelligent AI's Rebuild Cost Platform is a groundbreaking solution designed to tackle the challenge of underinsurance head-on. By incorporating open data, commercial data, and Satellite Earth observation data, this platform automates the property valuation process, offering several key benefits:

Speed: Traditional property valuations can take one to two weeks to complete. However, with the use of intelligent algorithms and satellite data, Intelligent AI's platform can reduce this process to mere minutes.

Accuracy: The platform combines various data sources, including location, building footprint, height, wall materials, roof materials, occupancy, number of floors, building costs, demolition costs, planning, and professional fees, to provide highly accurate property valuations. This minimises the risk of underinsurance.

Cost-Effective: By automating the valuation process and reducing the need for extensive manual assessments, property valuations become more cost-effective for all parties involved, including insurers, surveyors, and property owners.

Space Added Value

This project will focus on EO data fusion combined with artificial intelligence and extensive location data to provide insurers and brokers for the first time with innovative insights into commercial property risk and loss adjustment using enhanced location data and Satellite Image/Spectrum Analysis. These innovations move the insurance sector from annual risk data gathering and manual processes, to near real-time data analytics and deliver much improved risk insight, risk mitigation, faster claims processes, lower operating costs and much better user and customer experience.

We are focused on 2 areas of innovation for the Insurance sector, that utilise satellite technology:

-

Use of Satellite Image Analysis for delivering building characteristic data, including height, size, materials etc.

-

Significantly improving Rebuild Cost Validation with automated data collection and Satellite Imagery Analysis.

Current Status

We held technical workshops with BCIS (Chartered Surveyors), QBE (Insurer), Swiss Re (Insurer), BCH (Chartered Surveyors), Charterfields (Chartered Surveyors), Liberty Mutual (Insurer), The Hartford (Insurer), and presented to an audience of 400 Insurers and Broker at Lloyd’s of London. In addition, we held meetings regarding Rebuild Cost Assessment at an InsTech London event. Development progresses well with further iterations presented to users and feedback being put back into further iterations. Features we have been exploring include: automated building occupancy generation, cost calculation mappings, and the ability to create and store a “narrative” about the rebuild cost assessment.