Objectives of the service

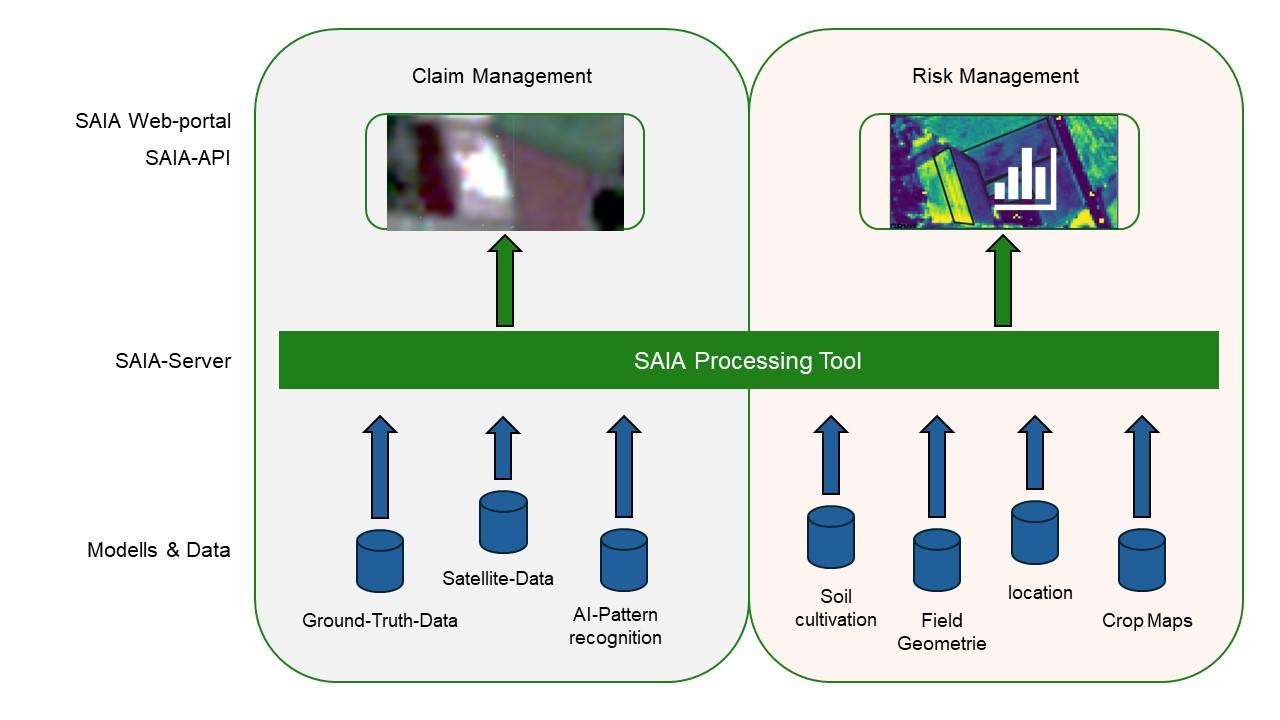

The product has two components: The claim management tool and the risk management tool.

The issue with claim management is that assessing the damage on site in the fields takes a lot of time and incurs very high costs. In addition, there are increasingly fewer trained employees who can carry out this task. To support the claim management process, CORAmaps has developed a product that analyses satellite data to recognise inhomogeneous structures in a field and identify them as damage.

To this end, various satellite data, weather data and other geodata are analysed using artificial intelligence and linked together so that they can be evaluated for each individual field.

The issue with risk management is that insurers have no insight into how high the risk of damage is in a field and can only cover this by collecting their own data. Here, satellite earth observation offers the possibility of creating a risk profile for each individual field based on previous damage, cultivation measures, surrounding cultivation area and landscape elements as well as weather and climate forecasts.

The individual tools are provided both in a web app and via an interface (API) for the insurance companies.

Users and their needs

The target customers of the service and products are agricultural insurance companies. Users are employees of these insurance companies, In particular, the claims adjusters who assess damage caused by weather events on site, as well as insurance company employees who have to make a risk assessment. In principle, there are no regional restrictions and the service can be offered worldwide.

For the claims adjusters, it is important to obtain an earth observation product that supports them in the assessment. The first step is to analyse the field to be inspected for inhomogeneous structures. With this knowledge, the claims adjusters can then precisely determine their counting points and thus survey the damage in a more targeted manner. In the case of simple damage events, damage assessment can be carried out using satellite data on the desktop alone.

The requirements of the claims adjusters are as follows:

-

User-friendly application

-

Fast and reliable data

-

High precision

-

Automatisation

Based on past data and current conditions, which are determined using satellite data, risk management employees can estimate how high the risk of renewed damage to a field is. The requirements of risk management are as follows:

-

Verifiable risk assessment

-

Very precise risk classification

-

Transparent criteria for risk classification

Service/ system concept

In order to be able to take a closer look at an agricultural field in the context of an agricultural insurance risk assessment, extensive information must be available. Crop rotation information, i.e. information on which crop was cultivated in which year, is fundamental.

Together with the information about the location and geometry of the field, a historical analysis of agricultural practice is carried out, which allows conclusions to be drawn about the actual risk of yield reduction when growing a specific crop. In this way, field-specific statements can be made about the risk and potentially more attractive contract conditions can be made possible. In the event of damage, affected areas of a field are detected reliably, precisely and automatically immediately after the event and the associated reduction in yield is estimated. On the one hand, this information is made available via a user-friendly portal without requiring the end user to have any knowledge of earth observation or geoinformation. On the other hand, the information can be retrieved via a machine-readable API, which allows deeper integration of the information into customer-specific workflows.

Space Added Value

The space assets used are basically all available earth observation satellites. Earth observation satellite data is analysed and linked with ground truth data as the basis of the technical development so that a programmed artificial intelligence can evaluate this satellite data with regard to certain patterns and thus recognise damage, among other things. The high frequency of the Copernicus mission's images should be seen as the basis for the feasibility of the service and the provision of information, because it is only by analysing large areas at short intervals that damage events can be recognised in good time and evaluated at an early stage. In the agricultural sector, the resolution is of secondary importance, but rather the temporal frequency is crucial. Compared to current methods used by insurance companies themselves to carry out claim management and risk management, satellite data offers immense advantages, as all areas can be permanently analysed and not just individual areas at individual points in time. In the case of very large fields (larger than 20 hectares) in particular, aerial surveys using drones are no longer economically viable and can only be carried out at individual points in time at great expense. Satellite data therefore offers a revolutionary further development for agricultural insurance.

Current Status

In the Kick Start project, a total of eighteen employees from five insurance companies were interviewed. In several meetings, the requirements of the employees were clearly formulated and the possibilities of satellite monitoring were communicated. This resulted in a catalogue of requirements in consultation with the insurance companies, which included the desired tools and evaluation options and structured them in terms of time and development effort.

In addition, initial tests were carried out to investigate the analysability of the satellite data with regard to the detection of damage on agricultural land and successfully demonstrated that this approach is effective. In consultation with the persons surveyed, it became clear that the installation of a corresponding service for claim management already has high added value and pain points were found among the pilot customers. This justifies the establishment of the service and provides the prerequisites for a successful market launch.