Objectives of the service

Production of soft (agricultural and timber) commodities is threatened by significant environmental risks, such as deforestation and fires. Financial Institutions invest in producers, traders and consumer goods companies more downstream in the supply chain, and demand increased transparency on what is happening on the ground. This is because the environmental risks are not only an issue for the health of the planet, but it can also lead to PR risks and/or financial consequences for example the inability to raise new funds for Investment Funds or losing out on new mandates for Asset Managers and Pension Funds.

There is great momentum among Financial Institutions to join the sustainability effort in soft commodity production. Many Financial Institutions and businesses are committed to reduce emissions, reduce deforestation and transition to renewables. Investment Funds launch more climate funds whilst Asset Managers and Pension Funds are decarbonizing their portfolios by publicly announcing divestments from coal. More and more companies are focusing on supply chain engagement and transparency as a pathway to risk reduction and brand value. However, for the Financial Institutions it remains a challenge to act and engage with their (potential) portfolio companies or assets because it is unclear what the risks exactly are and where they happen in the supply chain.

With SatSource, Satelligence informs Financial Institutions where the risks are and how to mitigate them. Investment Funds and Asset Managers around the world can now track the environmental risks for their (potential) portfolios in real time. The information is easy-to-use and reported in such a way that it can be used directly for engagement with companies or assets at risk and for in- and external reporting. Reduced environmental risks will result in increased sustainable soft commodity production and hence a viable business model in the long term.

Financial Institutions receive customized, easy-to-read, environmental risk summary reports with more detailed information made available through annexed reports. Also portfolio-level evaluations and trends will be made available, while keeping proprietary information secure. With such an approach, Financial Institutions will be able to integrate environmental monitoring into their core business strategy the same way they track other variables — like exchange rates, governmental based interest rates or stock markets — that can impact the risk of their commodity related businesse

Users and their needs

The SatSource service targets key Financial Institutions in the financial sector working with agricultural commodity supply chains including Banks, Asset Managers, Pension Funds, Development Banks and Institutions, and their clients (e.g. Producers, Traders and Consumer Product Manufacturers).

With SatSource we collaborate directly with Robeco, Actiam and UNEP. The interest of these organization is getting easy-to-use, actionable and transparent supply chain information at the source, so that they can make sustainable investment decisions.

The organizations have a global focus, but initial focus will be on specific agrocommodities (palm oil in Indonesia, Malaysia, and soy in Latin America).

Service/ system concept

The user will get information on supply chain risks (e.g. deforestation) through the SatSource service. Satelligence develops, in co-creation with end users, algorithms in combination with AI to determine where the highest portfolio risks are. The user can then make an investment decision or engage with their assets to improve sustainability.

The secondary users (traders, plantation companies) can make use of the information to tackle the areas of highest risk and improve transparency and sustainability in their supply chain.

The online service at the core of the architecture runs on Google Compute Engine, offering data storage, processing, and linkage to the user interface. The user interface offers simple reporting (graphs and tables) derived from the (geo)data, accessed through a web browser allowing users to either upload their own project/portfolio data, or select available data, and visualise the context of the location of their projects/investees on continuously updated land cover-based performance and risk maps, associated risk insights, and other related georeferenced data.

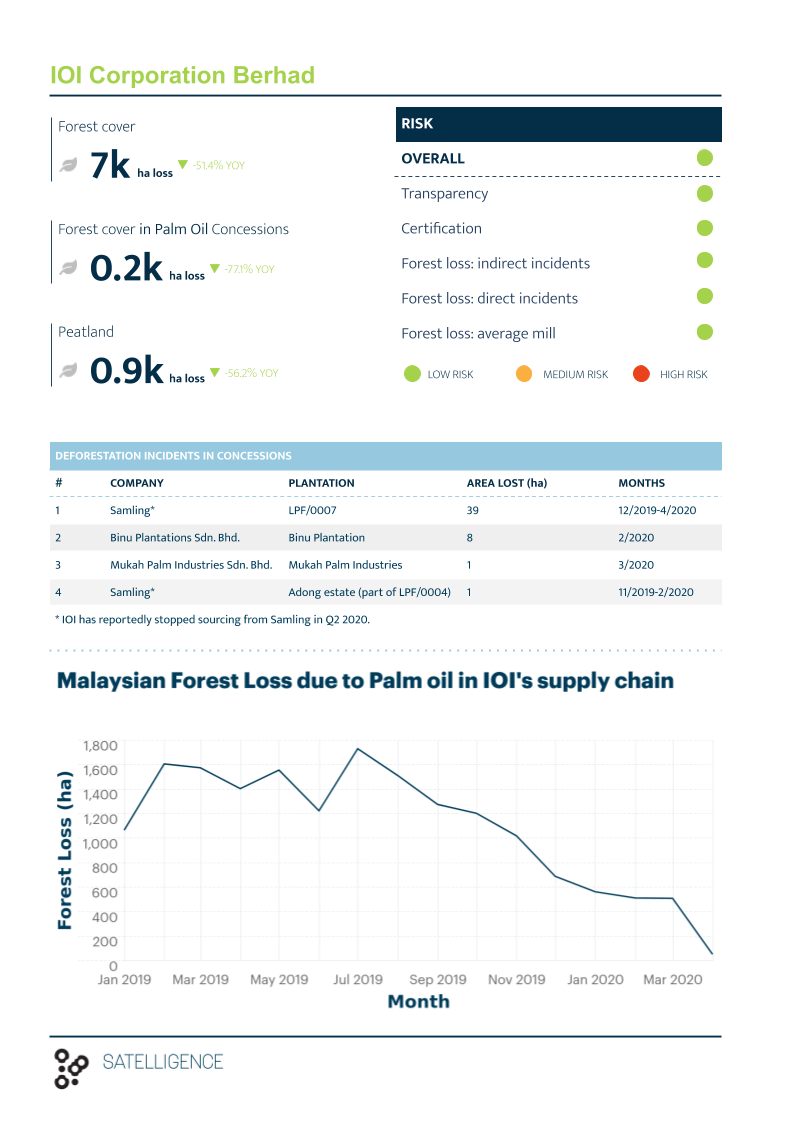

Below is an example of the Proof of Concept for company-based deforestation risk:

Image credit: Satelligence, Project: SatSource

Space Added Value

Financial institutions need to assess risks for a portfolio of companies as well as specific investment projects. For most Financial Institutions, understanding of how companies, governments and other actors involved in the trade of agricultural commodities are linked to impacts and opportunities for more sustainable production is very limited.

Big data and geospatial technology has made environmental monitoring cheaper, more accessible and closer to real-time to keep up with the pace of the investment sector. Assessing environmental risk has become easier. Thanks to a shift toward using transparency data in business, Earth Observation at the source, geo-traceability and a new generation of databases and encryption technologies (including blockchain) it has finally become possible for brands to account for every smallholder in their end-to-end supply chains.

The main driver for the use of space assets is the need for independent evidence-based information during monitoring of compliance with sustainability standards and environmental impact frameworks, enhancing field survey information and increasing objectivity.

Current Status

The Feasibility study period run from August 2019 to August 2020. The following are some of the main outcomes of the activity:

- The business case for SatSource has been evaluated and validated.

- As a result of users interviews it has been concluded that two type of Financial Institutions, asset managers and investment funds, interested in SatSource services.

- The architecture has been defined based on user requirements.

- A Proof of Concept has been deployed, and it is actively being used by Asset Managers.

- Press releases with partner organizations have been published nationally and internationally: https://satelligence.com/news/2019/9/16/actiam-employs-satelligence-satellite-data-to-combat-deforestation

- Operational service delivery focuses on Asset Managers, Investment Funds and Sustainability Rating Firms.