Objectives of the service

The objective of the service is to monitor both a real-time feed of trade negotiations in financial markets and time aggregate performance metrics associated with that feed, such as total inquiries, for example. The volume of inquiries and the large number of clients and products covered by sales and traders is such that manual monitoring is not possible.

The service will provide rich, interactive alerts to Mosaic’s dashboard. The feasibility study explores the use of the local outlier probability model (LoOP), used by the ESA in telemetry monitoring. By using an anomaly detection approach, rather than hard thresholds, the service aims to minimise the number of false-positive alerts sent to users.

Users and their needs

The product users are sales people, traders, trading floor managers and back office staff working in financial services. Individuals cover multiple financial products and clients and monitoring the performance of all of them is difficult, particularly as significant volumes of negotiations are handled electronically.

- Identify spikes or drops in inquiries from a client (customer retention).

- Detect unusually large (‘fat-finger’) trades.

- Detect trades where quote time or negotiation time are very long.

Countries of users: United Kingdom, United States.[Image copyright: Mosaic Smart Data Limited]

Service/ system concept

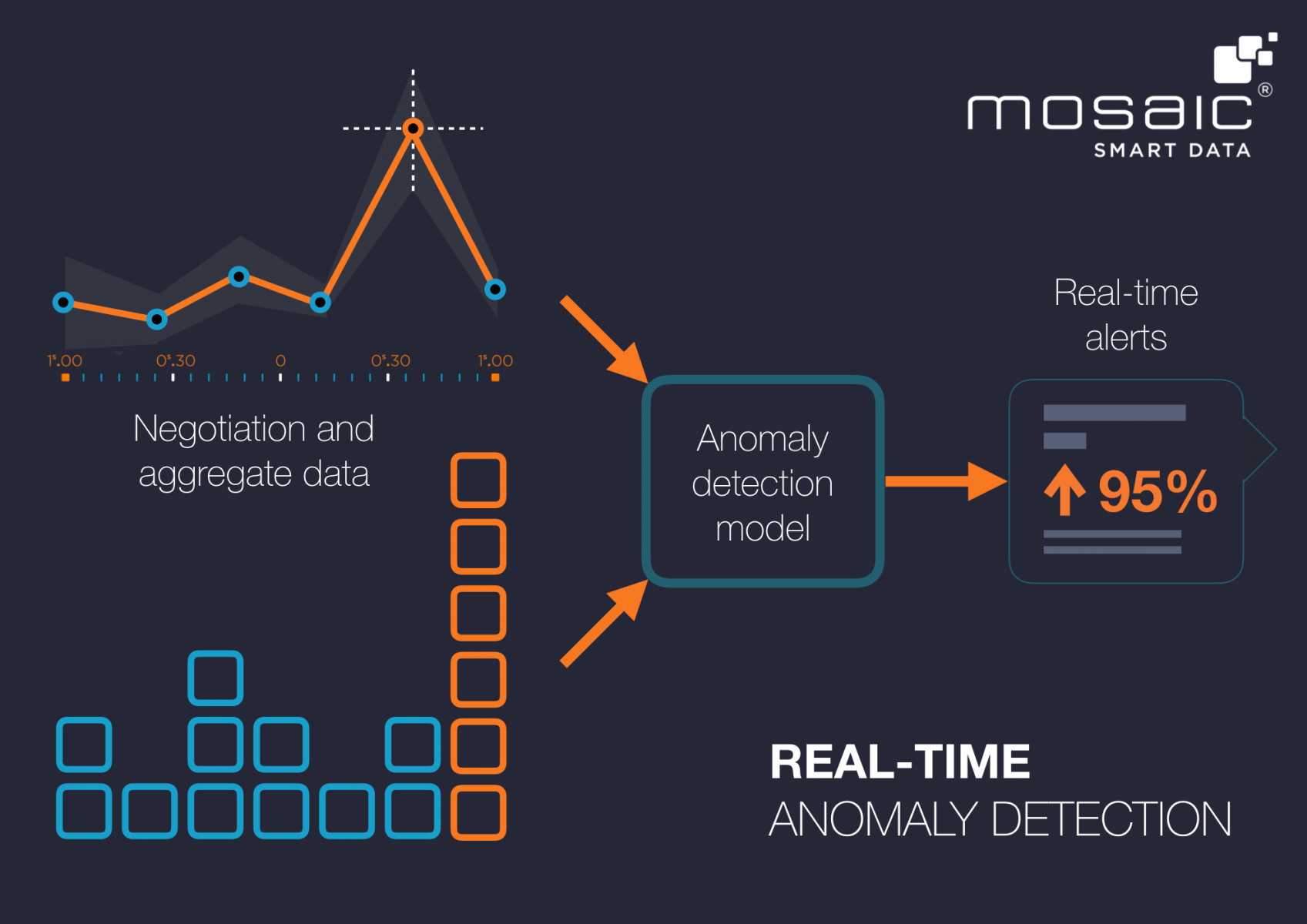

The user receives rich real-time alerts, with links to more detailed visualisations or tables elsewhere in the Mosaic platform which provide further details. Anomaly detection models are trained on historical data, partitioned appropriately according to product type and market. The input data comes from a time-aggregated database (performance measures) or streams API (negotiation data). This is then scored by the trained anomaly detection model which pushes alerts to Mosaic’s web dashboard if anomalies are detected, again via a streams API.

[Image copyright: Mosaic Smart Data Limited]

Space Added Value

The feasibility study explores the use of the local outlier probability model (LoOP), as used by the ESA in published research on telemetry monitoring and mission support tools (DrMUST). By combining the LoOP anomaly detection model with financial market event and performance data, the feasibility study evaluates the potential for a new service for the Mosaic platform which automatically monitors data for unusual patterns and alerts users when this is detected. The study activities include benchmarking the LoOP model against other anomaly detection models.

[Image copyright: Mosaic Smart Data Limited]

Current Status

The feasibility study has completed and the resulting anomaly detection service is in user acceptance testing. Benchmarking the LoOP model against other anomaly detection techniques showed that, for the data used in this study, although the LoOP model was competitive with other techniques, it does not offer any significant advantages over them.