Objectives of the service

Global climate and environmental changes demand more sophisticated risk models and risk transfer solutions to address the increased severity and frequency of catastrophic events. Since the 1980s, average annual losses from natural disasters have more than sextupled in real terms (source: Swiss Re). Insurers require digitized risk assessment systems with consistent real-time data to adapt to the evolving risk landscape.

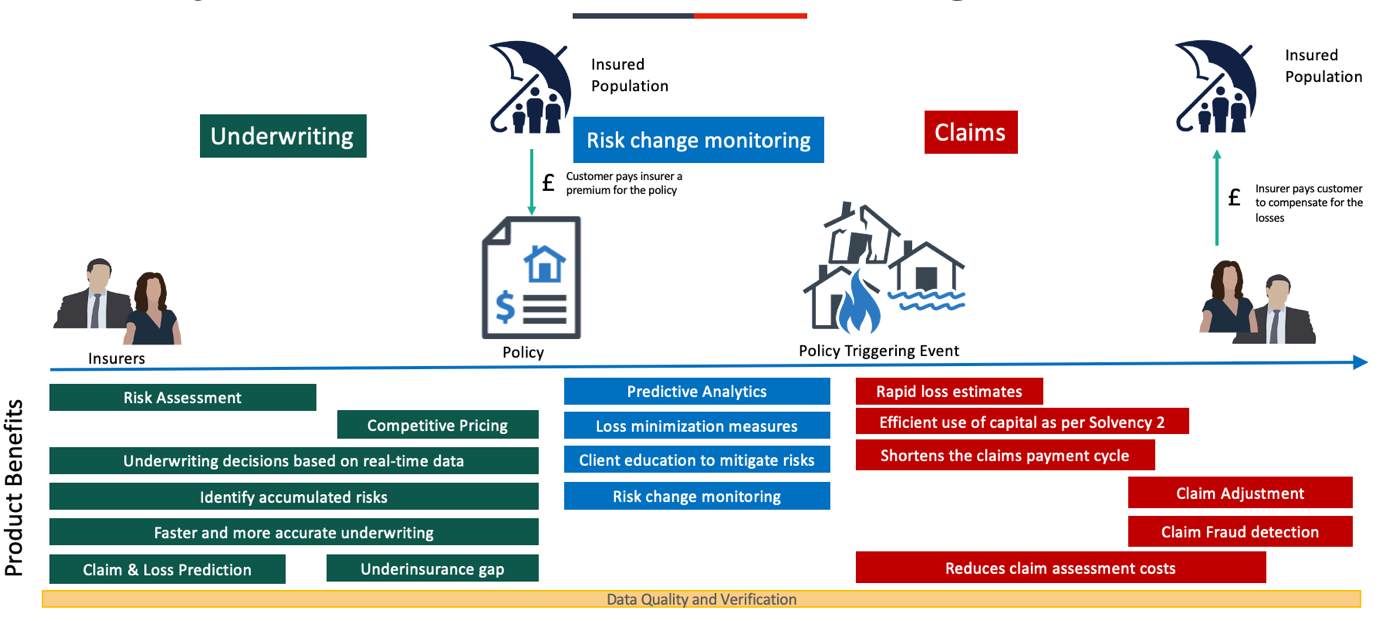

The TerraRisk cloud-based data fusion platform consists of AI-powered risk selection for remote underwriting and claim assessment. IoT, political, economic, natural catastrophe (Nat-Cat) and near real-time environmental data is integrated into a customised, user-friendly interface, offering a holistic risk assessment for every policy. Users are provided with the analysed risk profile to make efficient and informed decisions to remotely classify and monitor risk.

Utilizing remote sensing technology alongside the integrated datasets, the Software-as-a-Service (SaaS) platform improves data-driven decision making. This offers insurers predictive and prescriptive insights into the properties’ risk exposure, leading to greater accuracy in underwriting processes. Loss estimates after natural catastrophes can be assessed remotely, significantly increasing the efficiency of the service whilst reducing the claims assessment costs and increasing profitability for the insurance sector.

Users and their needs

CyStellar targets its offering to reinsurance, brokers, agents, and capital market financial services organizations. The TerraRisk platform holds the capacity to be utilised worldwide. The feasibility of the approach has been investigated in the context of users that have policies distributed throughout the USA and Europe.

Examples of end users within the insurance sector, and their needs:

Underwriters

-

Data-driven accurate insights into risks of individual property/ policy’s

-

Accessible, reliable sources of collated (Nat-Cat) risk information for informed decision making and to cognise present and future risks.

-

Identification of risks attributed to remote areas for portfolio expansion opportunities.

-

Customized hazard level algorithms reflecting the risk appetite of the insurer.

-

Communication/ transparency with property claims history to underwrite risk more effectively.

-

Data validation and verification

Claims Assessors

-

Near real-time environmental data for claim/event validation.

-

Remote assessment of damages for pay-out estimates.

-

Near- real-time risk management data service to mitigate risks and minimise property damages.

Challenges for the project to meet these needs:

- Service users are reliant on outdated methods of working and may be reluctant to adapt their strategies to a new way of working.

- Often, carriers have yet to fully realise the potential of their data assets – for example, claims histories and distribution interactions.

Service/ system concept

Given any location on Earth where an insurance policy exists, the platform automatically gathers all data to make a cumulative risk assessment.

-

The system gathers data from radar and optical satellite imagery, from IoT sensors, social, economic, or political data sources.

-

The AI and machine learning engine automatically detect risks and identify correlations. Underwriters can analyze patterns of real-world activity to uncover signals of high risk at a property before confidently pricing a policy.

-

Remote claim assessments are conducted by the system pulling in environmental data from and around the date of the claimed event and validate whether the conditions at the time met those testified to cause damage.

-

Loss detection based on satellite data confirms the extent of the damage visible from space to assist in the damage and loss assessment.

Features:

Underwriting

-

Accurate input into risk selection and underwriting, reserving and ratemaking, exposure and aggregate management, portfolio optimization, pricing, and reinsurance.

-

Access to data visualization on the platform and numerical risk values to assess and underwrite Nat-Cat risk

-

Customized hazard level and risk evaluation for each policy at a roof top level.

Claims

-

Event near real-time environmental condition verification for claims assessment.

-

Before and after event analysis, automated post-event loss assessment, fraud detection and claim adjustment.

Portfolio Level Analysis

-

CyStellars data and technology can address remote properties and areas which otherwise would have been overlooked by insurers due to lack of insight into the risk. With this information, insurers can expand their portfolios by insuring the otherwise up till now ‘uninsurable’.

-

Statistical analysis across and within portfolios for loss ratio assessment and premium distribution costs.

Space Added Value

Space technology advancements will provide valuable insights to the insurance industry to remotely assess and monitor risk. The project uses satellite optical images as well as radar imagery for automated risk detection and assessment:

-

Sentinel-2 data through the Copernicus Open Access Hub and SentinelHub. The data is used to complement the post event loss estimates (NDVI analysis for crop insurance, Normalized Burn Index damage analysis after fire events), live exposure and claims triage functionality of the platform.

-

High-resolution optical imagery from private satellite image providers for AI training of buildings characteristics classifiers.

-

Synthetic Aperture Radar (SAR) Imagery from Sentinel-1, free online access from archive (>24h from observation) for flood damage assessment and land subsidence risk analysis.

-

Integration with Copernicus Emergency Management Service (Copernicus EMS): Global Flood Awareness System (GloFAS), Global Wildfire Information System (GWIS) and Global Drought Observatory (GDO). The EMS data is used for supporting pre-event insurance client loss mitigation and minimization measures.

Current Status

As of October 2022, we have completed the feasibility stage of the project. CyStellar’s objective is to proceed to the demonstrator collaborate phase throughout the duration of 1.5 – 2 years.