The impacts of climate change on the environment and human society have led to an increased vulnerability of developing countries to extreme weather events and an increase in water and food needs, as well as a general decrease in biodiversity, human health, and ecosystem health.

The Intergovernmental Panel on Climate Change (IPCC) identified finance as one of the main catalysts and drivers to enhance resilience to climate change impacts and reduce the impact on the environment. The contributions of both the finance community and the real economy are key to achieving the Paris Agreement and climate objectives.

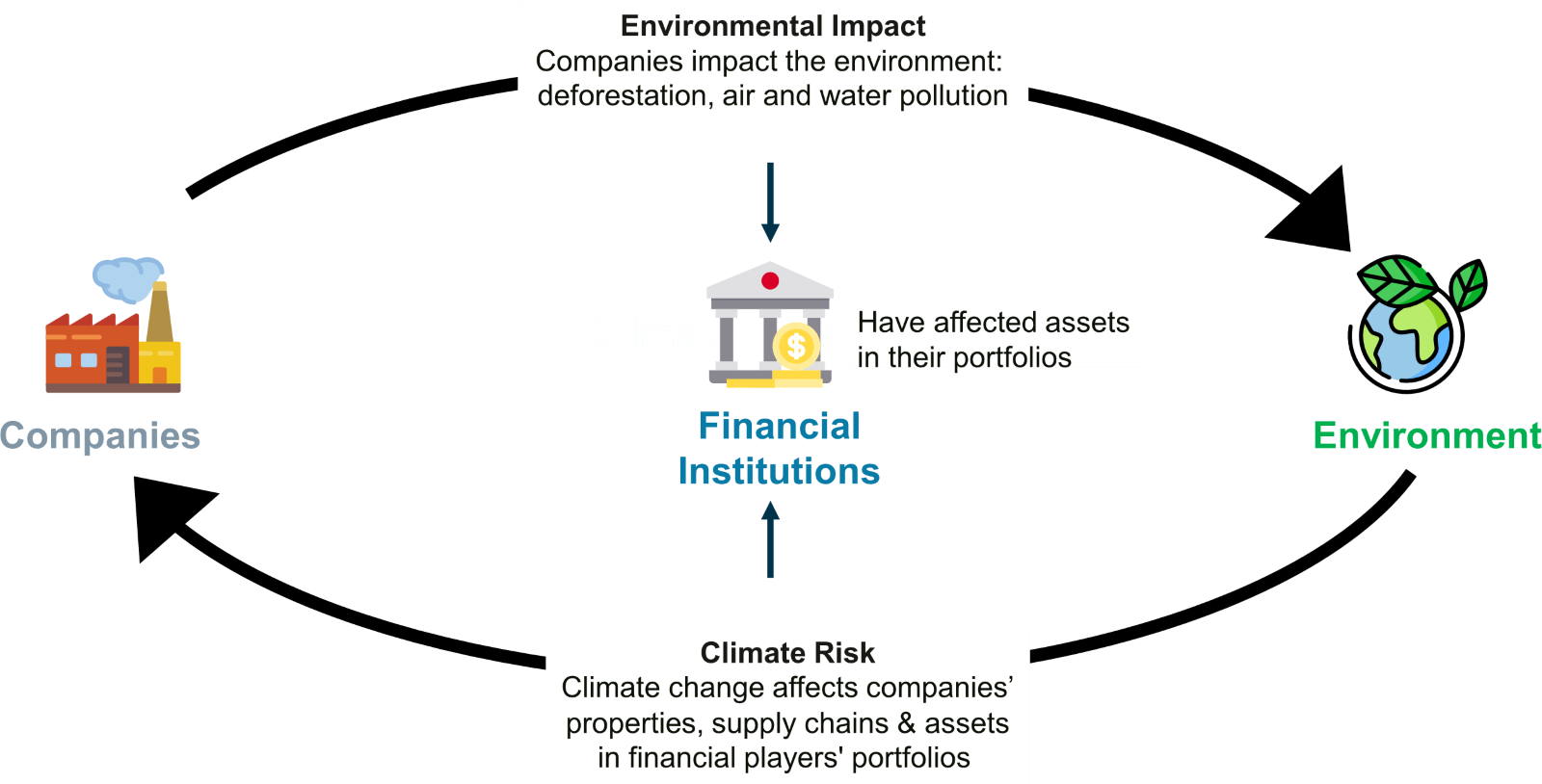

Companies of the real economy, such as in the energy and utilities, agriculture and food, smart cities, mobility, manufacturing, logistics and other sectors, are exposed to physical and transition risks due to climate change that can affect their properties, assets, and supply chains. As these industries plan their transition to more sustainable business models and more resilient asset bases and supply chains, they will need capital to deliver on these objectives. Solutions are needed that can help companies attract capital and investment for their transition plans and investment needs and to comply with disclosure requirements. Challenges include the reporting of progress and impact to investors and stakeholders, tracing and improving the sustainability and environmental impact of the entire value chain for companies selling goods and services to end users and understanding and mitigating negative environmental impact.

Financial Institutions, such as banks, investors, asset managers or insurers, involved in the financial flows to and from companies, attribute an increasing importance to climate change due to the real economy’s risk exposure as well as their environmental impact. Identifying and managing physical and transition risks are important challenges, which can relate to real estate values, non-performing loans and credit losses, or the volatility of financial instruments. Understanding organisations’ environmental impact is relevant to both comply with reporting obligations and to make better investment decisions towards a green transition. Reliable, verifiable, consistent, and timely insights about corporations’ sustainability factors and risk exposure are needed to build the environmental, social and governance (ESG) products, for own investment and risk management processes, and regulatory compliance.

Public institutions are developing policies and regulations in several jurisdictions to promote sustainable investments. Corporate disclosure of climate-related information has been the driver of different guidelines and legislation around the globe. For example, the European Green Deal aims to facilitate public and private investments required for the transition to a climate-neutral, green, competitive, and inclusive economy. As part of this, the EU Taxonomy, Non-Financial Reporting Directive and Sustainable Finance Disclosure Regulation were established. The European Green Deal Investment Plan will mobilise at least €1 trillion EUR of sustainable investments over the next decade. The UK Green Finance Strategy aims to become the world’s first net zero-aligned financial centre. Switzerland makes climate disclosures mandatory. Many other countries develop similar strategies and regulations.

Initiatives such as the Taskforce on Climate-related Financial Disclosures (TCFD), the Taskforce on Nature-related Financial Disclosures (TNFD), and others develop recommendations and frameworks for organisations to report and act on climate-related issues. Increasingly, governments are adopting such recommendations or frameworks as baseline for regulations to ensure companies include these aspects as part of their mainstream activities.

Financial data providers, such as rating agencies or consultancies, are working on filling the disclosure gap, but indicators differ depending on the used methodology or framework, as no harmonized standard has emerged yet.

The Opportunity

With climate change action increasingly urgent, regulation on sustainable finance being established, and a need for action by different players of the ecosystem, space data and technology can be an enabler of solutions for a green transition. This funding opportunity seeks to develop and assess business ideas for new space-enabled commercial services that help companies use space for acting on:

- Greening Finance: understanding and mitigating the financial implications posed by the transition to a net-zero climate-neutral economy in companies and supply chains.

- Financing Green: supporting new investment decisions and opportunities to meet environmental targets and comply with international policies as part of green transition initiatives.

Topics of Relevance

Insights for assessments and predictions, underpinning the access to information in support of financial decisions and the shift of financial flows to be aligned with a net-zero and nature-positive economy, for example:

- Transition risk assessment and mitigation of impact: e.g., directly monitoring greenhouse gas emissions or monitoring proxies to inform carbon intensity metrics in real economy sectors such as heavy industry, energy, manufacturing, etc., relevant to meet obligations/commitments from financial institutions to report on climate risks or emissions.

- Physical (climate) risk assessment and mitigation of impact: e.g., developing physical climate risk scoring or ratings to compare risk exposure between companies and portfolios, relevant to investment and credit analysis. Physical risks may originate from extreme weather events or exposure due to longer-term climate impact. Exemplary data points identified in physical risk assessments are location of counterparty assets, resiliency plans, expected impacts, regional climate, data, vulnerability to physical risks, granular forward looking location maps for flood, hurricane, wildfire hazards, vulnerabilities for droughts, damage to fixed assets, like buildings and property, or supply chain disruptions.

- Climate risk reporting: e.g., reporting tools for corporates to collect information on supply chain emissions or other environmental impacts, relevant to listed companies required to report on climate, nature/biodiversity or other environmental, social, governance (ESG) impacts.

- Climate risk finance: e.g., developing new indices for parametric insurance products as an efficient way to cover communities against the damages of climate hazards such as flooding, cyclones, droughts, etc. Particularly in the case of developing countries, it is important to mobilise the resilience and adaptation to cope with the financial impact of climate-related damages and impact.

- Adaptation planning and fundraising: e.g., climate risk assessment tools for governments and public/multilateral finance institutions to optimise and prioritise investment project pipelines and integrate climate resilience considerations in project design. Particularly in the case of developing countries, it is important to mobilise the resilience and adaptation to cope with the financial impact of climate-related damages and impact.

Financial products and services for sustainable impact, for example:

- Monitoring, reporting and verification for green finance products: e.g., monitoring use of proceeds from green bonds or tracking the environmental performance of sustainability linked loans, relevant to the issuers of these products. Environmental factors can span diverse topics such as carbon emissions, product footprint, biodiversity and land use, raw material sourcing, water stress, toxic emissions and waste, package material and waste, electronic waste, clean technology, green building, renewable energy, and others.

- Enabling nature-based solutions (i.e., actions and policies that protect, manage, and restore natural ecosystems while addressing societal challenges) and ecosystem markets: e.g. quantifying ecosystem services such as carbon capture or clean water, to underpin carbon/water credit trading schemes, relevant to both the suppliers of carbon/water/nature credits products and corporates looking to offset their emissions.

Value of Space

Satellite data and technology can provide valuable information for financial institutions, complementing corporate disclosures and other news sources. Space-based datasets can enable the analysis of numerous climate and environment related risks, impacts and opportunities. Solutions based on objective, consistent, verifiable, and timely data can improve transparency and how financial institutions and companies screen investments, manage risks, engage with investees, disclose non-financial information, implement measures, and more.

Satellite Communication

Ubiquitous connectivity enabled by integrated terrestrial and satellite communications is a key enabler for many data driven products and services, for example by relaying the data collected by in-situ sensors particularly from remote areas. 5G integrated satellite and terrestrial communication networks can connect, for instance, local sensors and weather stations to the data analytics infrastructure.

Satellite Navigation

Satellite navigation can provide precise positioning and timing information, e.g., to locate assets, geo-tag data collected by in-situ sensors, such as Internet of Things (IoT) devices, or to timestamp information. For example, geo-located information collected from IoT sensors measuring the amounts of pollutants, possibly in combination with remote sensing, can help to locate source emissions sources.

Satellite Earth Observation

Satellite Earth observation can be used to collect diverse environmental data about air, land, and water via active – such as radar and synthetic aperture radar – and passive – such visible and thermal infrared – sensors. Earth observation insights, possibly in combination with geo-located in-situ data collected via Internet of Things devices, allow for the monitoring, mapping, change detection, and forecasting of indicators such as greenhouse gas emissions, the extent of oil spills, deforestation, flooding, and other climate-related impact or weather-related losses (landslides, flooding, drought, fires, cyclones, etc) and risks.

Integrated Platforms

The collection and integration of in-situ data with remote Earth observation data is at the basis of integrated data platforms supporting data analytics addressing the most complex challenges such as monitoring of greenhouse gas emissions, understanding the extent of oil spills, deforestation, flooding, and other climate-related impact, and enable the extraction of actionable insights. Integrated platforms can enable solutions such as performance tracking for green finance products to conclude on the environmental impact of borrowers; underpin, in combination with other geo-located data, nature-based solutions and ecosystem markets by allowing transparent verification of environmental impacts and reduce risks of greenwashing.

What We Offer

We offer funding and support to companies, both for business case assessment and for the development of new, space-based services. Our offer includes:

- Zero-equity funding

- Technical & commercial guidance

- Access to our network and partners

- ESA brand credibility

ESA will co-fund 80% of the acceptable cost, up to €200K, per awarded study.

We Look For

We look for promising business ideas addressing topics of relevance or related areas and that propose:

- Attractive market opportunities, identified customer needs, and customer engagement

- Commercially viable service concepts

- Technically feasible solutions

- Added value of space data or technology

- Motivated teams with business, technical, and finance domain expertise

Who Can Apply

This opportunity is open to companies that intend to develop space-enabled services and products related but not restricted to the key focus areas outlined above. To be eligible for funding, your team must be based in one of the following countries: Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Lithuania, Luxembourg, the Netherlands, Norway, Poland, Portugal, Romania, Sweden, Switzerland, and United Kingdom. Teams can involve non-European entities, but their contribution to the activity cannot be funded by ESA. Authorisation of Funding letters from the corresponding National Delegations are required as part of the application.

How to Apply

- Register your team on esa-star Registration today. If your team is made up of more than one organisation, each entity will need to register.

- Download the official tender documents from esa-star Publication (Announcement of Opportunity 1-11517) when the opportunity opens. This includes a letter of invitation, proposal template, draft contract, and additional information about this opportunity.

- Prepare your proposal using the official tender documents and reach out to your National Delegation to obtain a Letter of Authorisation.

- Submit your proposal via esa-star Tendering by the deadline.

Webinar

Speakers:

- Ana Raposo, Business Applications Officer at European Space Agency

- Christophe Christiaen, Innovation and Impact Lead at UK Centre for Greening Finance & Investment

- David Carlin, Task Force on Climate-Related Financial Disclosures (TCFD) and Climate Risk Program Lead at United Nations Environment Programme - Finance Initiative