On this page

SPACE FOR FINANCE AND INSURANCE

Space-enabled solutions to advance financial and insurance services

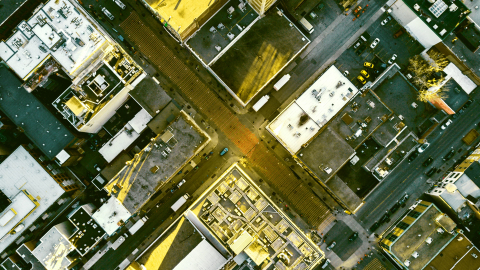

The financial sector is a key driver of the transition to a sustainable economy. At the same time, it is adapting to shifting data dynamics and competitive pressures while still confronting major challenges in cyber security, access to climate‑related data, regulatory compliance, and reaching under‑served markets.

Similarly, the insurance sector is emerging as a leading contributor to global Earth Observation revenues, while facing significant shifts in its challenges due to natural disaster – impacting damage assessments, asset monitoring, and more.

Space‑enabled solutions can enhance these services by improving data completeness, latency, accuracy, precision, and provenance. From delivering high-resolution and near real-time environmental intelligence to enabling transparent, traceable impact verification, new business models can reduce underwriting and investment risk and expand access to finance where it is most needed.

Through Business Applications and Space Solutions (BASS), ESA'S ACCESS programme supports businesses across different sectors and countries by enabling space‑based solutions to strengthen core financial and insurance operations, and to unlock new opportunities for sustainable growth.

Data from July 2025

How can space support financial and insurance services?

Data from satellite missions in Earth Observation (e.g. the Copernicus Programme), Communication (e.g. Artemis), and Navigation (e.g. Galileo) are the main key space assets and are complemented by technologies from human spaceflight. In particular, they can help add value as follows:

|

Satellite Earth Observation (SatEO) and Remote Sensing (RS)

|

|

Satellite Communications (Satcom)

|

|

Positioning, Navigation and Timing (Satnav)

|

What areas do BASS projects tackle in finance and insurance?

Green Finance |

ESG Reporting |

|

|

|

|

Climate Risk Assessment |

Real Asset Monitoring |

|

|

|

|

Commodity trading |

Insurance |

|

|

|

|

How does ESA support space-enabled solutions?

Depending on their level of maturity, ESA provides different funding options – ranging from exploring product-solution fit (Kick-start) to Proof-of-concept Studies, and validation with users, with trials (Pilot Projects). Companies can apply year-round through the Open Calls for Proposals.

The Finance and Insurance Working Group at BASS has also launched several thematic calls around finance in the past, such as Kick-starts on Blue Capital, FinTech, Sustainable Financial Services, and Environmental Claims with Green Finance use cases, as well as insurance-related use cases on coastal resilience. In addition, the group has engaged with multiple partners to better understand market needs.

In the future, the finance and insurance sectors are expected to play a pivotal role in driving innovation, resilience, and sustainable growth across the global economy.