Objectives of the service

Users in the agricultural sector need accurate, field-level insights to manage climate-related risks that affect their crops and investments. Banks, insurance companies, and large agribusinesses struggle to find reliable ways to measure and price these threats, leading to uncertainty in lending and insurance pricing. AgroRisk tackles this challenge by combining satellite Earth Observation data with advanced data modeling. Through this platform, farmers and financial institutions gain precise analyses of soil conditions, weather trends, and future crop performance.

AgroRisk is delivered as an online service with a user-friendly interface that integrates seamlessly into existing systems. Its outputs include detailed risk scores, yield forecasts, and regulatory compliance support, enabling evidence-based decisions about financing, insurance products, and sustainable land management. The activity involves validating the technical foundation of the platform, refining its business model with real users, and ensuring readiness for broader implementation. The goal is to create a reliable solution that strengthens agriculture’s resilience and fosters informed financial practices.

Users and their needs

Banks, insurance companies, and large agribusinesses in Denmark are the primary user communities for AgroRisk. They urgently require detailed, field-level data on climate risks to optimize loan and insurance pricing, as well as to comply with stricter EU sustainability regulations. AgroRisk also serves larger farming enterprises overseeing multiple properties, where near-real-time insights can improve resource allocation and reduce vulnerability to extreme weather events.

Key user needs:

-

Integration of climate and financial risk data for accurate credit and insurance decisions

-

Compliance support aligned with EU environmental requirements

-

Early detection of adverse weather and crop conditions

-

Actionable analytics to guide sustainable farm management

Major challenges include ensuring robust satellite data processing across diverse agricultural conditions, alongside translating complex climate indicators into straightforward financial metrics. This calls for advanced modeling techniques and strong user engagement to validate and refine AgroRisk’s accuracy.

Once the service is developed for Denmark, it will be scaled to cover other countries in the EU.

Service/ system concept

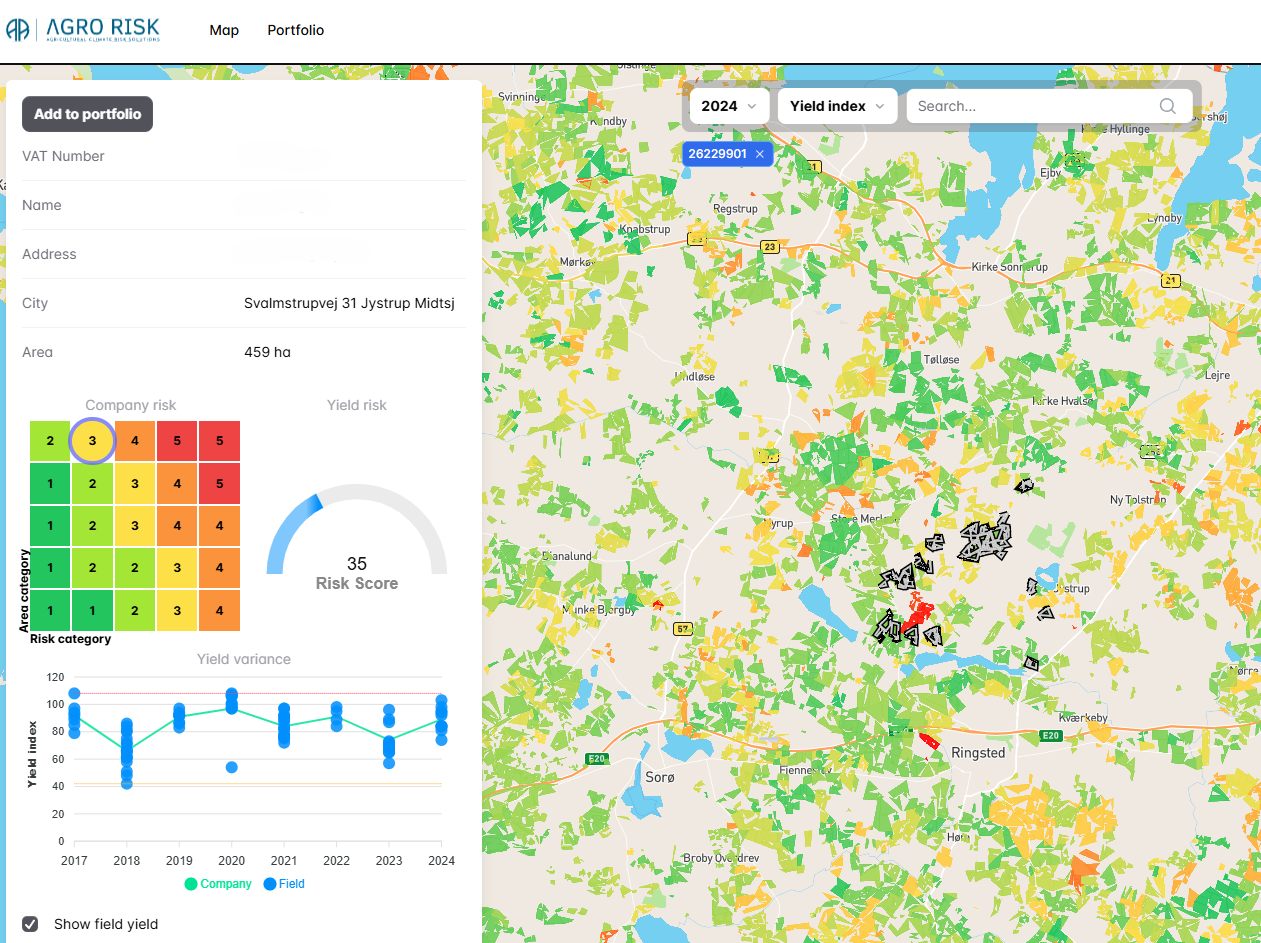

AgroRisk delivers field-level risk evaluations by combining satellite images, climate data, and financial metrics into easy-to-understand insights. Through a user-friendly dashboard, financial institutions and agribusinesses see real-time updates on how changing weather patterns might affect each field, enabling precise credit and insurance decisions. Key features include interactive risk scores, yield forecasts, and alerts for extreme weather events, all designed to streamline compliance with EU sustainability requirements.

Under the hood, AgroRisk relies on a cloud-based data pipeline that merges Earth observation satellite feeds with geospatial analysis. This data is processed by predictive models, which flag emerging threats such as droughts or floods. A simple front-end interface then presents risk maps and detailed field reports, ensuring that users can quickly adapt their strategies to reduce losses and enhance climate resilience.

Space Added Value

AgroRisk relies on Copernicus Sentinel-2’s high-resolution optical imagery as the foundation of its climate risk analysis. By detecting subtle changes in vegetation health and soil patterns, these images reveal early signs of drought stress or potential crop failure.

AgroRisk’s platform then integrates these findings with advanced climate models to predict how extreme weather events might evolve. Finally, these climate projections feed into specialized financial models that calculate potential credit and insurance losses, offering a precise, field-by-field risk assessment.

This approach surpasses traditional methods that often rely on sparse ground surveys or outdated regional data. Sentinel-2 enables timely, detailed observations, ensuring AgroRisk can flag emerging threats before they escalate. When combined with robust climate and financial analytics, these satellite insights translate directly into actionable recommendations—whether to adjust lending rates, update insurance coverage, or shift farming practices. The result is a significantly clearer picture of agricultural risk, providing banks, insurers, and large agribusinesses with the accurate data they need for informed and resilient decision-making.

Current Status

AgroRisk’s current demo model spans 70% of Denmark’s farmland and is undergoing pilot tests with four banks, one insurance provider, and multiple farm operators. It covers five major crops, blending satellite imagery from Sentinel-2 with predictive climate analytics to forecast both yield performance and weather-driven risks. Alongside these climate insights, AgroRisk integrates a specialized financial model that quantifies potential impacts on lending and insurance portfolios. Early feedback from pilot users has guided improvements in the platform’s interface and accuracy. The next phase will involve refining the risk indicators based on real-world usage data and expanding coverage to additional crops.

Prime Contractor(s)

Subcontractor(s)